There is “a very good chance” that President Donald Trump will announce his pick to lead the Federal Reserve before Christmas, according to the Cabinet official leading the search process.

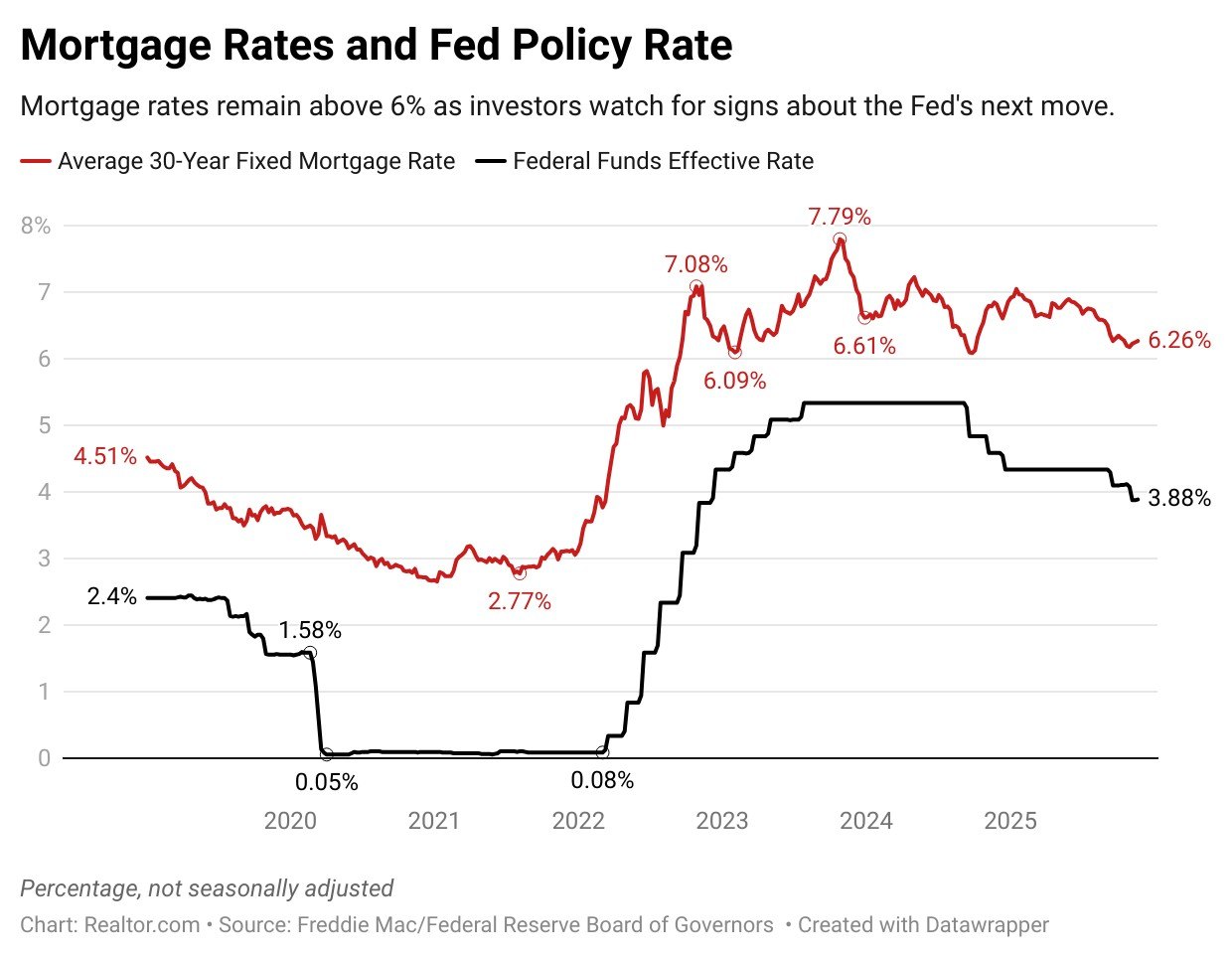

Current Fed Chair Jerome Powell‘s term will expire in May, and Trump’s early announcement of Powell’s successor could influence interest rates, including mortgage rates, by setting expectations about the central bank’s future policies.

Treasury Secretary Scott Bessent is leading the search after narrowing the list of candidates to five finalists, and said on Tuesday morning that he would conduct the final interview later in the day.

“There’s a very good chance that the president will make an announcement before Christmas,” Bessent told CNBC. “It’s his prerogative, whether it’s before the Christmas holidays or in the new year, but things are moving along very well.”

Among the five finalists, prediction marketplace Polymarket currently favors Kevin Hassett, who is director of the White House National Economic Council and Trump’s closest adviser on economic issues.

Other candidates with decent odds include Kevin Warsh, a former Fed governor appointed by George W. Bush, and Christopher Waller, a current Fed governor appointed by Trump.

The long shots among the finalists are Trump-appointed sitting Fed Gov. Michelle Bowman and BlackRock investment executive Rick Rieder.

Although the Fed chair is just one vote on the 12-member Federal Open Market Committee (FOMC), which sets interest rate policy, the role carries an important voice with significant influence on the economy and housing market.

Trump has made no secret of his desire for lower interest rates, which would juice the economy and reduce government borrowing costs. But after piling public scorn on Powell earlier this year, the president has eased off his attacks since the FOMC began gradually reducing rates in September.

The five finalists to replace Powell have all voiced support for lower interest rates, but the nominee will ultimately have to balance that outlook with the need to maintain credibility with markets as someone who takes the threat of inflation seriously.

“Ideally, the chair is someone who can encourage open debate that considers a wide range of perspectives,” says Realtor.com® Chief Economist Danielle Hale. “At the same time, at the end of the discussion, the chair needs to be able to drive the committee to a decision, ideally one supported by a large majority.”

Bessent told CNBC that during the selection process, a key theme that emerged was simplifying the Fed, which he says has become too complex in its goals and operations.

“In talking to these candidates, I realized the Fed has become this very complicated operation. It’s no longer just a price setting of money. There’s this very complicated calculus between the monetary policy, the balance—the balance sheet, and regulatory policy,” said Bessent.

Bessent said that in interviews with the candidates, he had probed their perspectives on how the Fed could best focus on “protecting the American people, protecting the economy, and moving forward with the dual mandate” of price stability and maximum employment.

Although Bessent declined to offer any hints about which candidates are front-runners for the role, his comments about simplifying the Fed correspond closely to Warsh’s public remarks about his vision for overhauling the central bank.

In interviews and a recent Wall Street Journal op-ed, Warsh has called for significant reform at the Fed, including dramatically reducing or even eliminating the assets on the central bank’s balance sheet.

Warsh, who was serving as a Fed governor during the 2008 financial crisis when the Fed began buying up Treasury bonds and mortgage-backed securities to provide liquidity to markets, says the time to end those crisis measures is long overdue.

“The Fed’s bloated balance sheet, designed to support the biggest firms in a bygone crisis era, can be reduced significantly,” he wrote in the Journal. “That largesse can be redeployed in the form of lower interest rates to support households and small and medium-size businesses.”

Warsh also believes that the Fed should limit its involvement in banking regulation and supervision, telling Barron’s that those functions would be better carried out by a political agency with more accountability to voters.

“The Fed’s rules and regulations have systematically disadvantaged small and medium-size banks, which has slowed the flow of credit to the real economy,” he wrote in the Journal.

Meanwhile, Bloomberg on Tuesday reported that Hassett, Trump’s right-hand man for economic matters, is now viewed by close advisers and allies as the front-runner for the nomination.

Sources told the outlet that Hassett is seen as sympathetic to Trump’s crusade for lower rates at the Fed, which Trump has sought to exert greater influence over in his second term.

Miami market relevance

If this topic impacts buyers or sellers, the most useful context is what is happening locally. Track current pricing, inventory, and days on market in Miami, and compare active listings by building or neighborhood before making decisions.