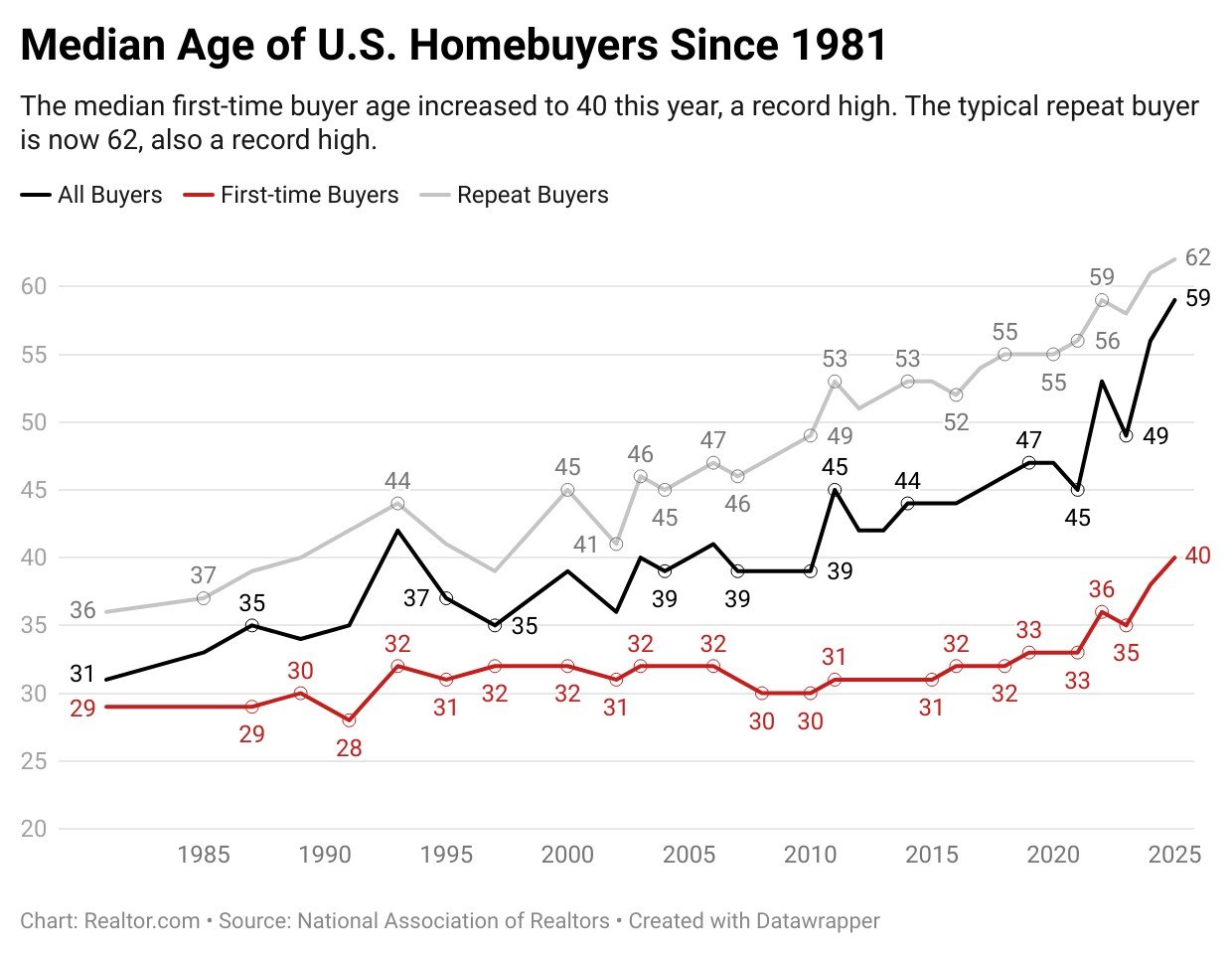

The typical first-time homebuyer in the U.S. is now 40 years old, a record high, as affordability struggles price many younger families out of the market.

The median age of first-time buyers rose to 40 in 2025 from 38 the year before, and is up sharply from 33 just five year ago, according the annual profile of homebuyers and home sellers released by the National Association of Realtors® on Tuesday.

The share of all home purchases that were made by first-time buyers fell to 21% this year, the lowest on records dating to 1981. Meanwhile, cash buyers accounted for 26% of sales, an all-time high.

Affordability remains a key struggle for first-time buyers, with home prices at record highs and elevated mortgage rates adding to the cost of purchasing.

“The current affordability challenges in the housing market affect everyone, but especially first-time homebuyers,” says Realtor.com® senior economist Joel Berner. “The housing market is missing these buyers, as many starter-level homes are spending longer on the market and receiving more price reductions, hindering the ability of those starter-home sellers to make purchases further up-market.”

Among first-time buyers, 25% were single women and 10% were single men, as the share of married couples remained flat at 50%.

In 2025, first-time homebuyers had a median household income of $94,400, down slightly from the prior year, but still well above the national median income of $81,604.

The typical down payment for first-time buyers was 10%, matching the highest share recorded since 1989, as buyers who could afford to put cash down targeted more affordable monthly payments.

First-time buyers were most likely to use personal savings (59%) or financial assets (26%) for their down payment, in contrast to past years when a gift or loan from a friend or relative was most common.

“Without equity built up in a home that they already own and can sell, first-timers have to rely solely on their personal savings to put together a down payment for their home purchase,” says Berner. “With a small down payment and mortgage rates still above 6%, many first-time buyers are facing down a monthly payment they simply cannot afford, so many choose to remain renters for the time being.”

Repeat buyers are also the oldest on record

The typical repeat homebuyer is now 62, also the highest ever, while the median age of all homebuyers also increased to a record-high 59, according to the NAR report.

While those trends partly relate to the country’s changing demographics, with the large baby boomer cohort now aged 61 to 79, they also reflect a housing market increasingly dominated by those at or near retirement age.

A whopping 30% of repeat buyers paid cash and did not finance their homes, with many of these buyers likely using substantial equity from the sale of a prior home to pay for their new house.

The typical repeat buyer made a hefty down payment of 23%, substantially higher than the median 10% down payment for first-time buyers, allowing them to avoid some of the pressures of higher mortgage rates.

Notably, the share of homebuyers with children under the age of 18 fell to an all-time low of just 24%, a trend likely shaped by both the rising age of homebuyers and falling birth rates.

Additionally, among homebuyers who have children, 21% cited child care expenses as a barrier to saving up for a down payment.

Home sellers are holding property longer than ever

The typical home seller in 2025 has owned their home for 11 years, an all-time high. Tenure is up from 10 years last year, and from 2000 to 2008, it was just six years.

The typical age of home sellers was 64 this year, also the highest ever recorded. Of all homes sold on the market, 81% did not have children under the age of 18 residing in the home.

For all sellers, the most commonly cited reason for selling their home was the desire to move closer to friends and family (26%), followed by the home being too small (10%), the home being too large (10%), and a change in family situation (8%).

For recently sold homes, the final sales price was a median of 99% of the final listing price. Home sellers reported satisfaction with the selling process, with 88% either highly or somewhat satisfied.

While the new report paints a somewhat bleak picture for first-time buyers, there are reasons to hope that conditions for them may improve, says Berner.

“Fortunately for prospective first-time homebuyers, mortgage rates are at their lowest level in over a year, which makes a home purchase with a smaller down payment more affordable, and the inventory of homes for sale continues to grow, which will put downward pressure on prices,” he says.

Average rates on 30-year mortgages reached a one-year low of 6.17% last week, according to Freddie Mac. And home price growth has weakened considerably, with prices now falling in several markets in the South and West.

“Conditions are turning in favor of buyers, which should help first-timers break into the market if they are willing to take on the risks of homeownership for a chance at the benefits,” says Berner.