Mortgage Applications Today: Home Loan Demand Decreases Despite Lower Mortgage Rates

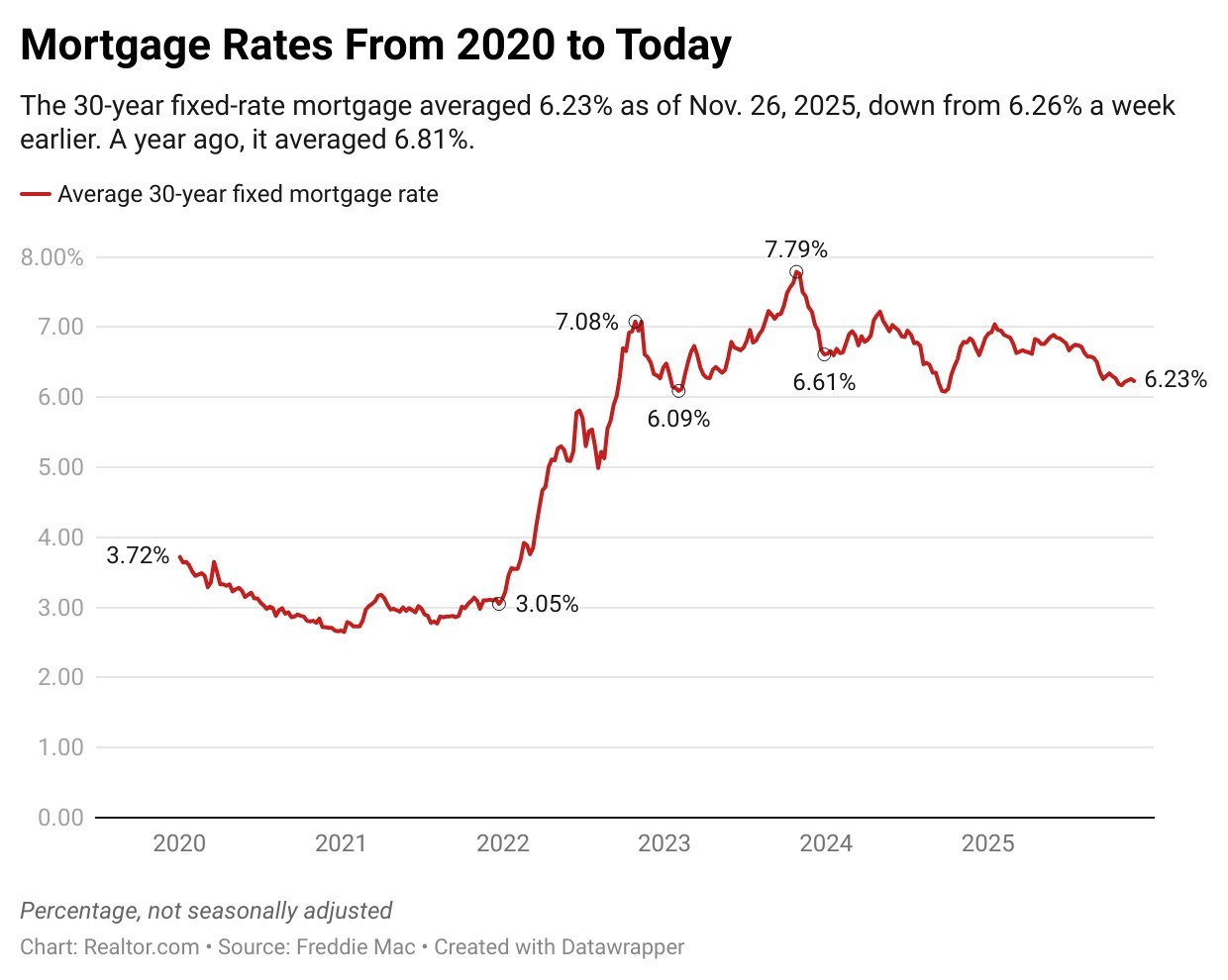

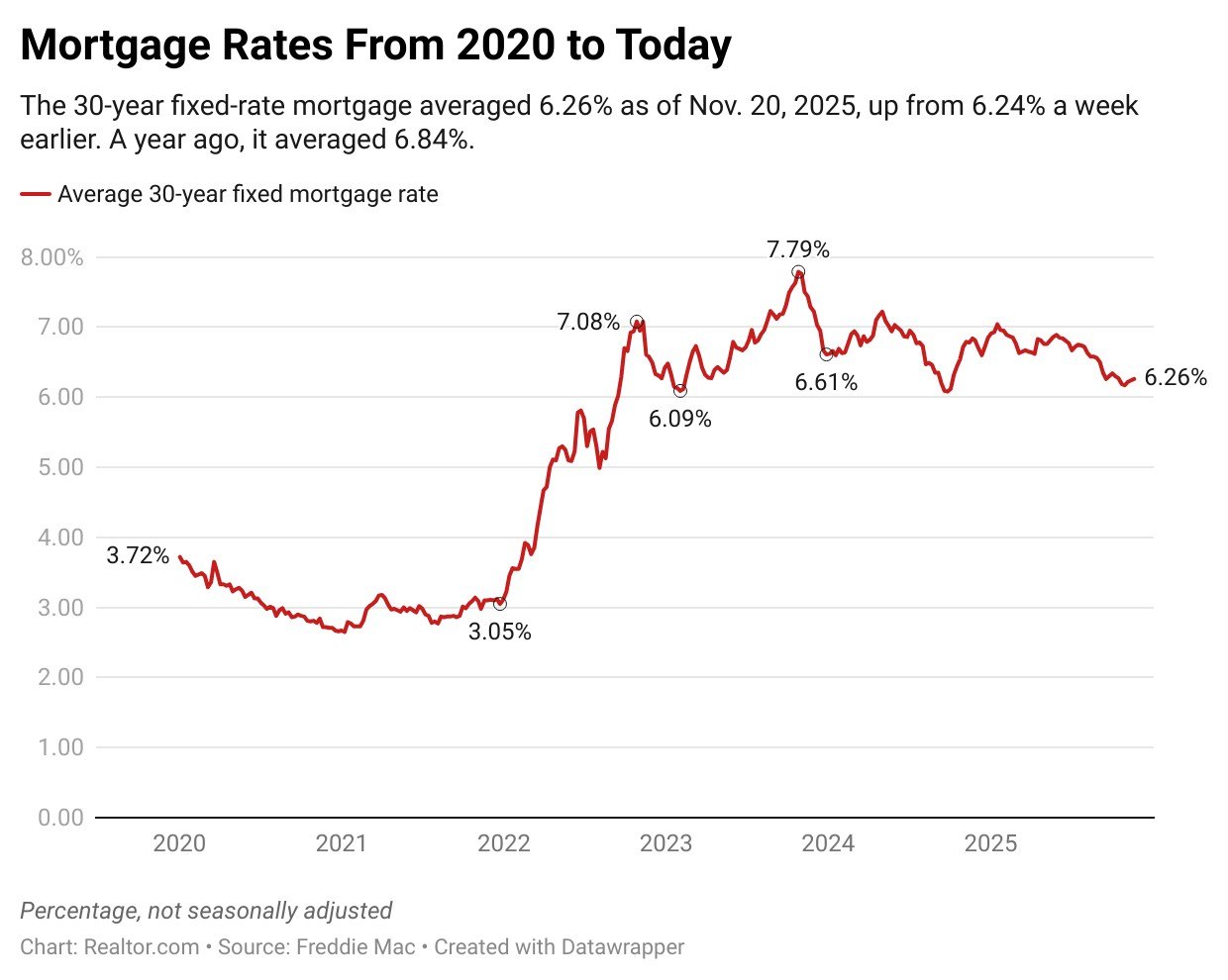

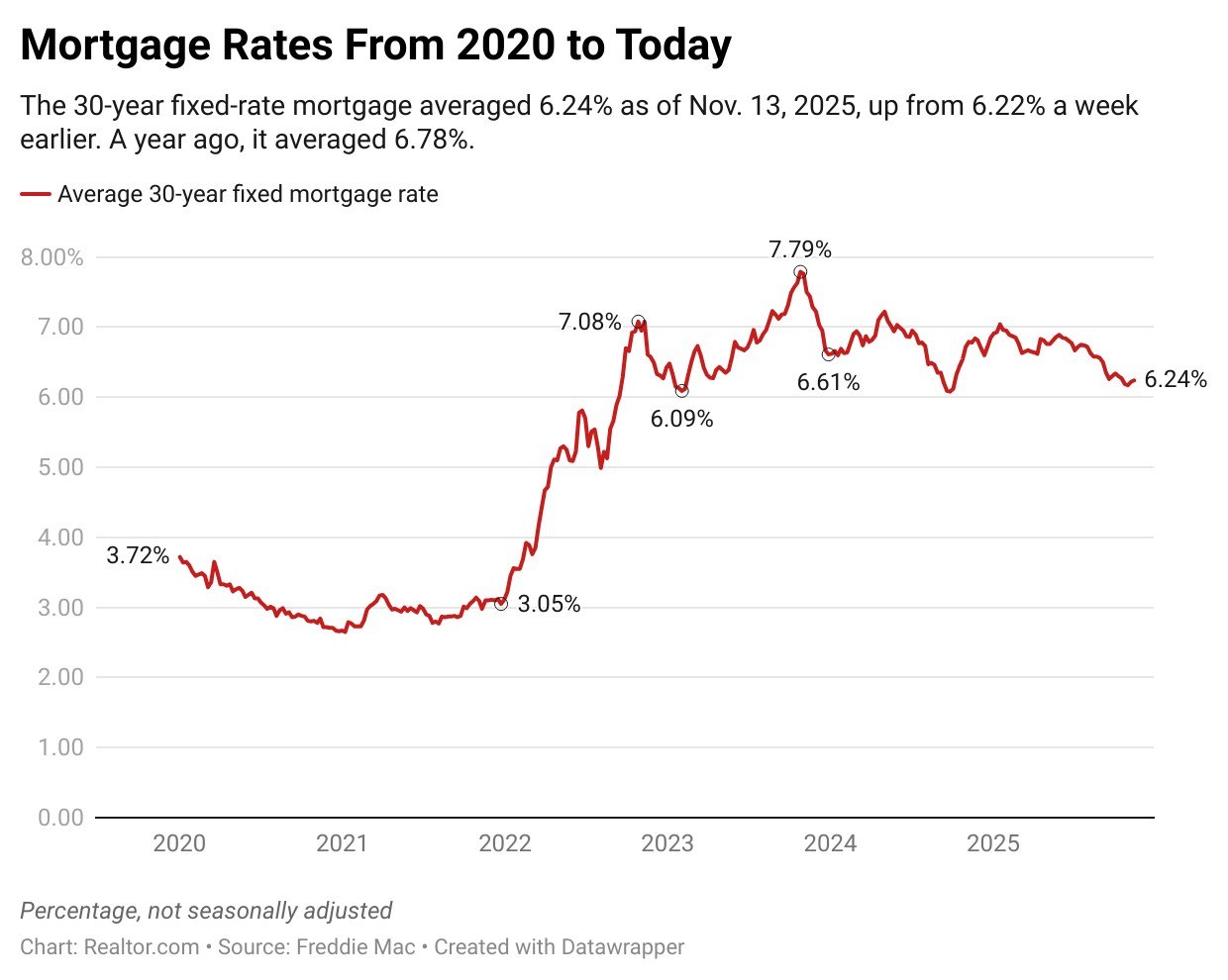

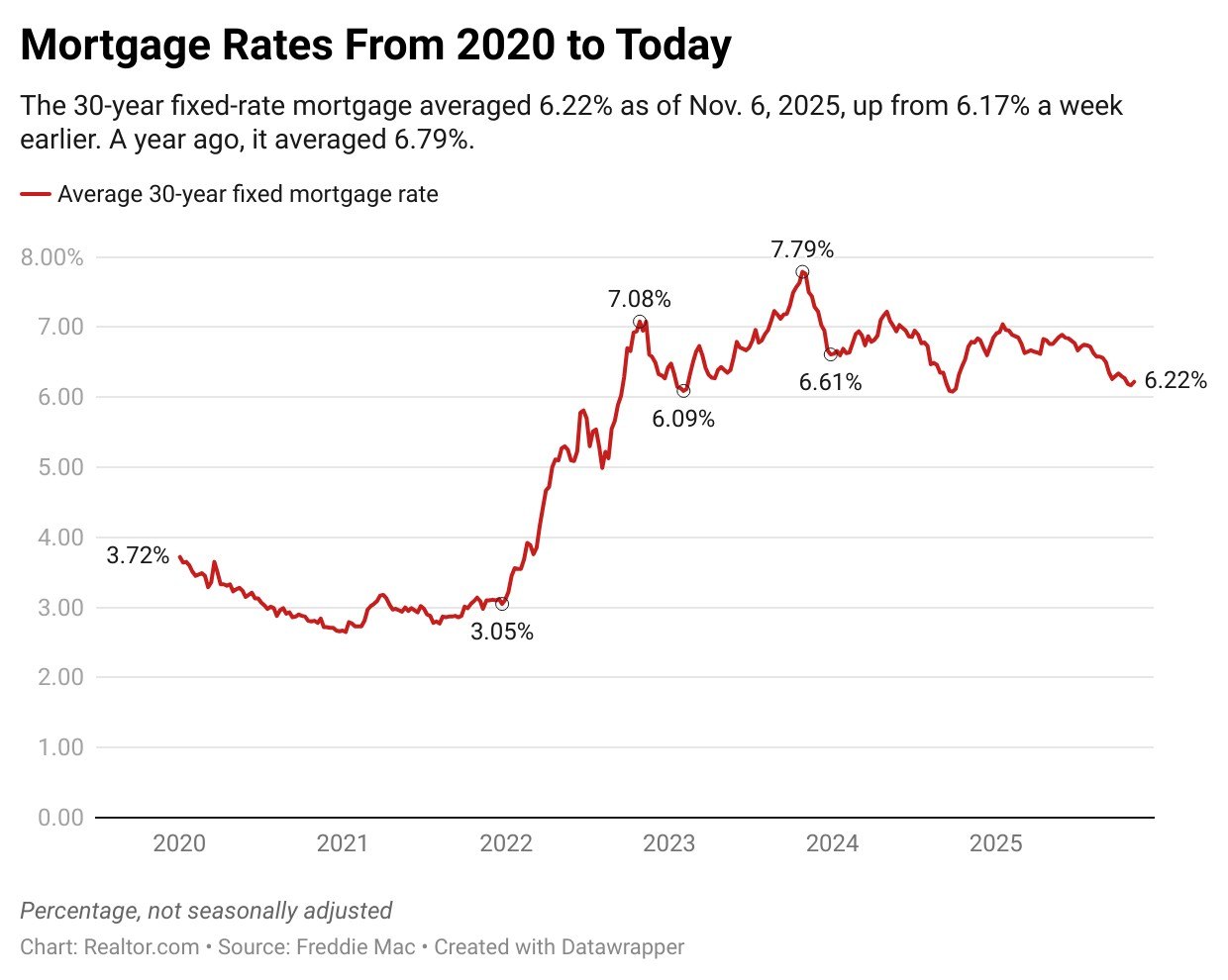

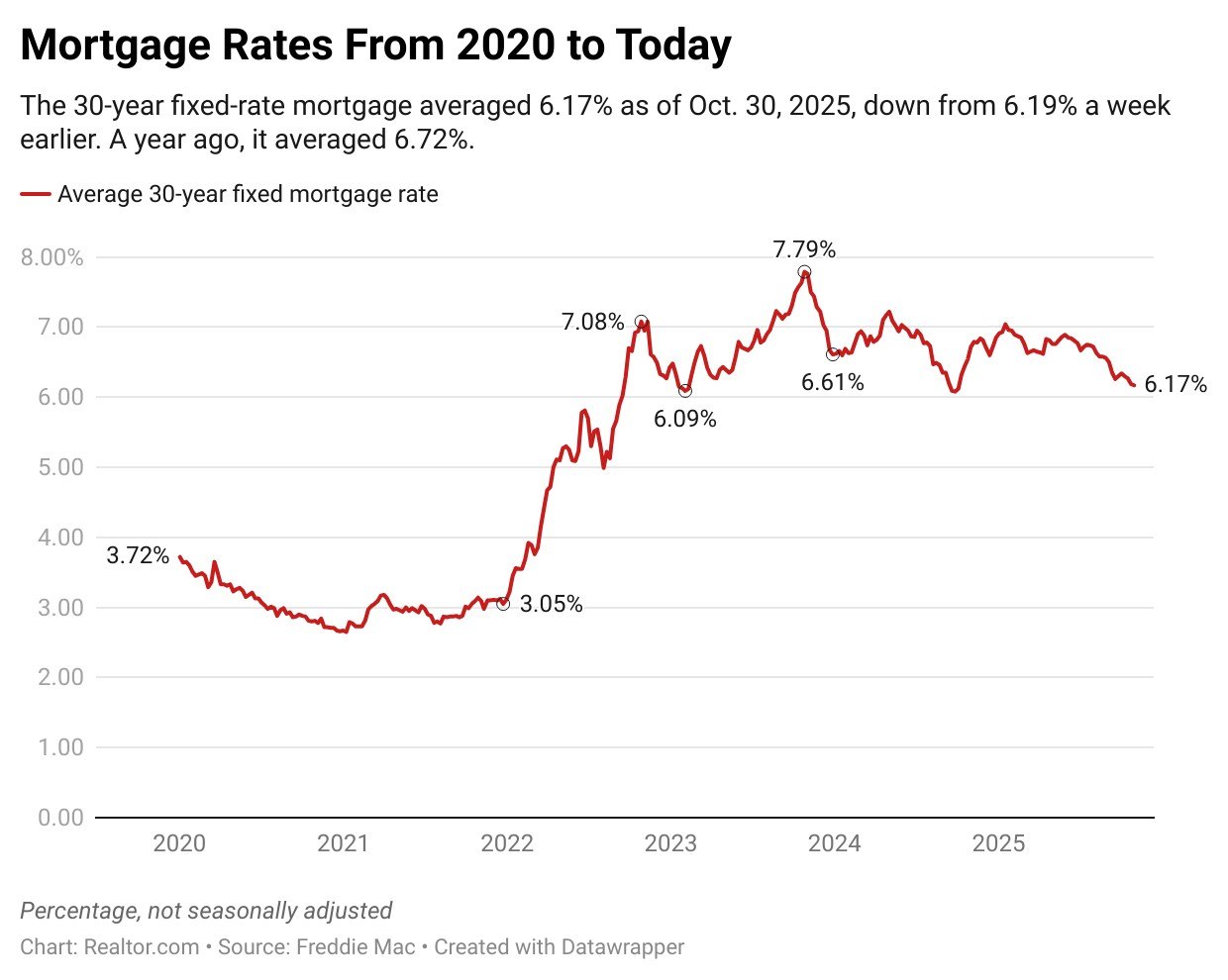

The demand for a home loan continues to take an up and down path as applications decreased 1.4% for the week ending Nov. 28, according to the Mortgage Bankers Association. This is down from the week prior when it saw applications increase 0.2%. The total is also adjusted for the Thanksgiving holiday. The Market Composite … Read more