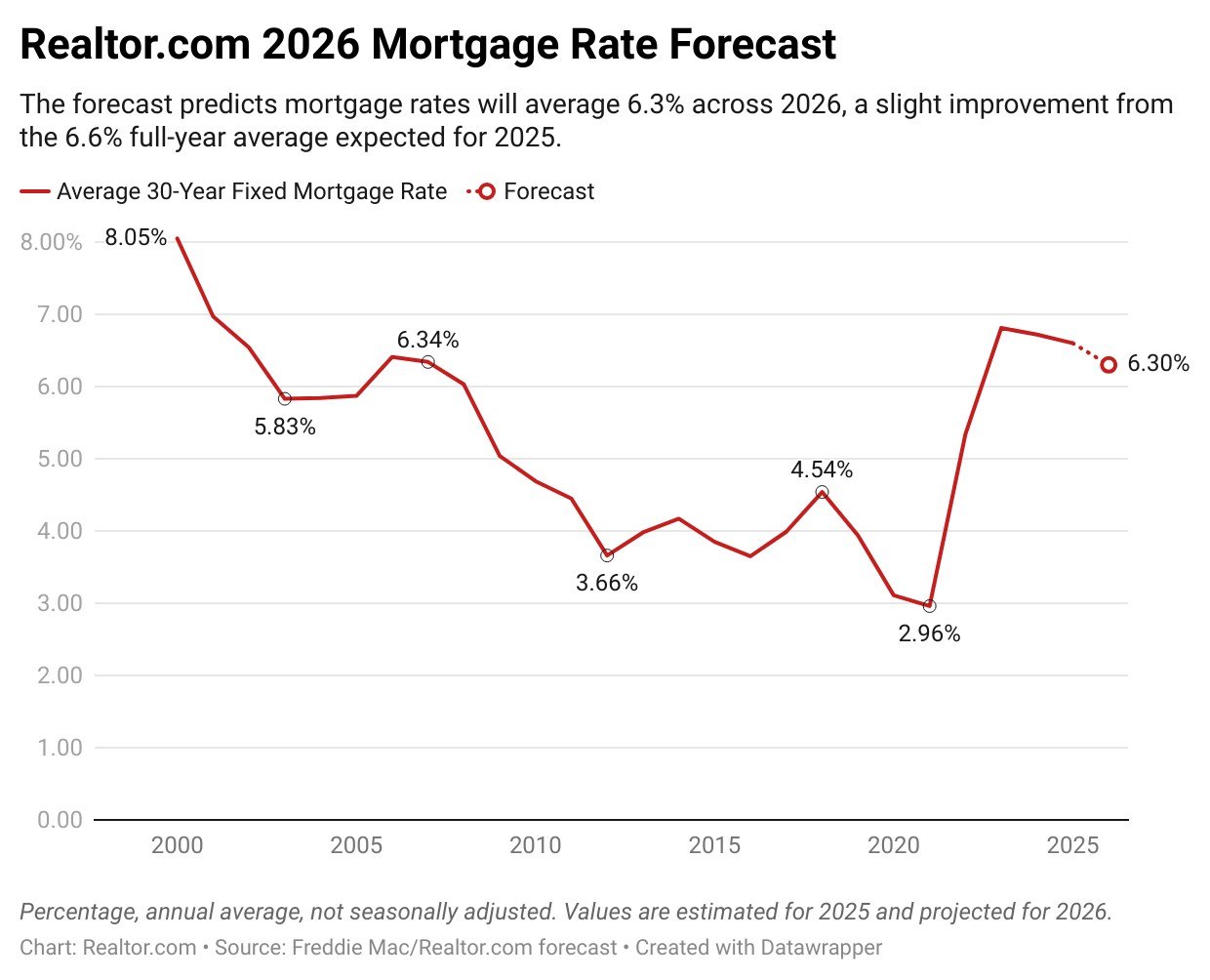

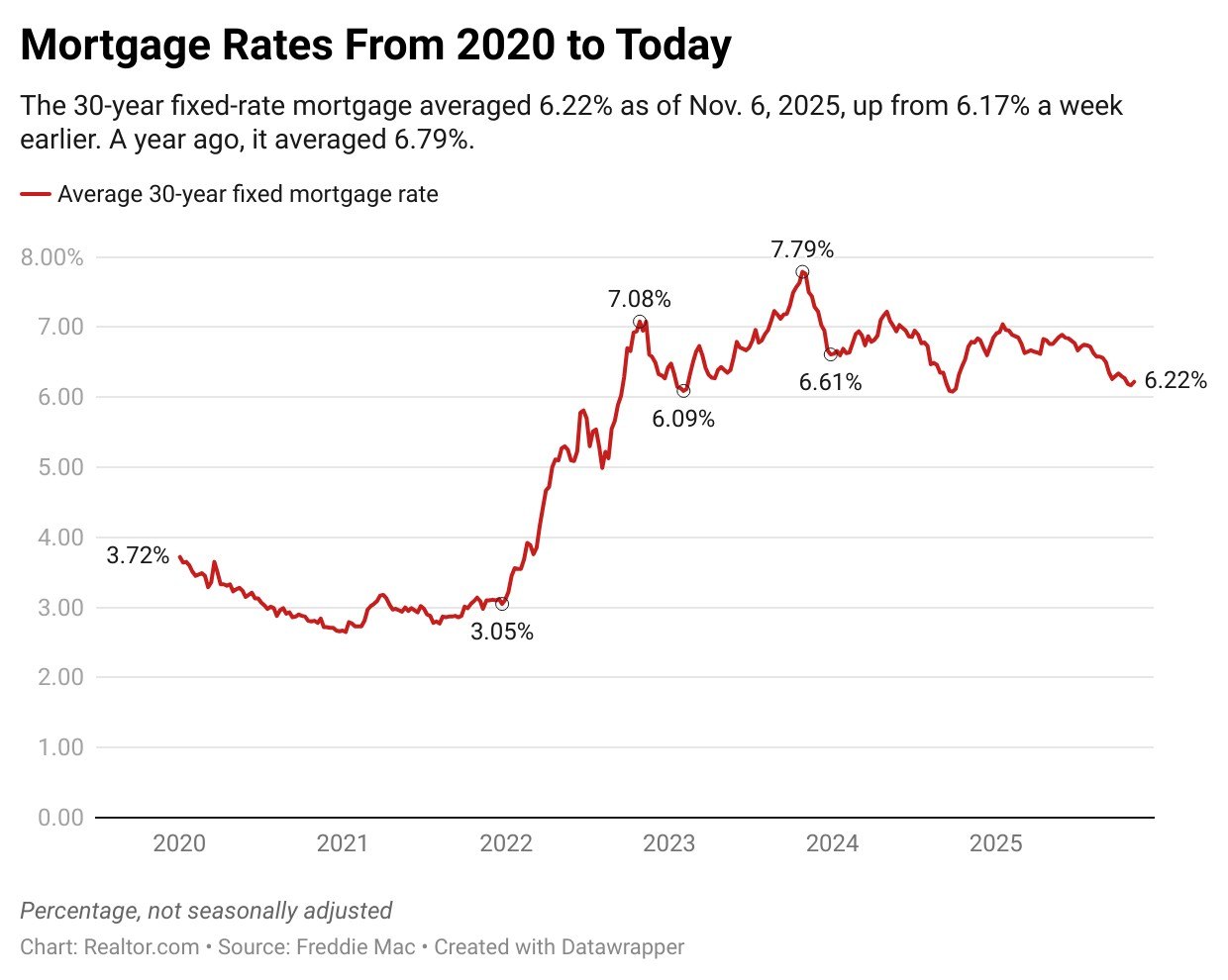

Housing Forecast 2026: Mortgage Rates Remain Above 6%, but Affordability Improves Modestly

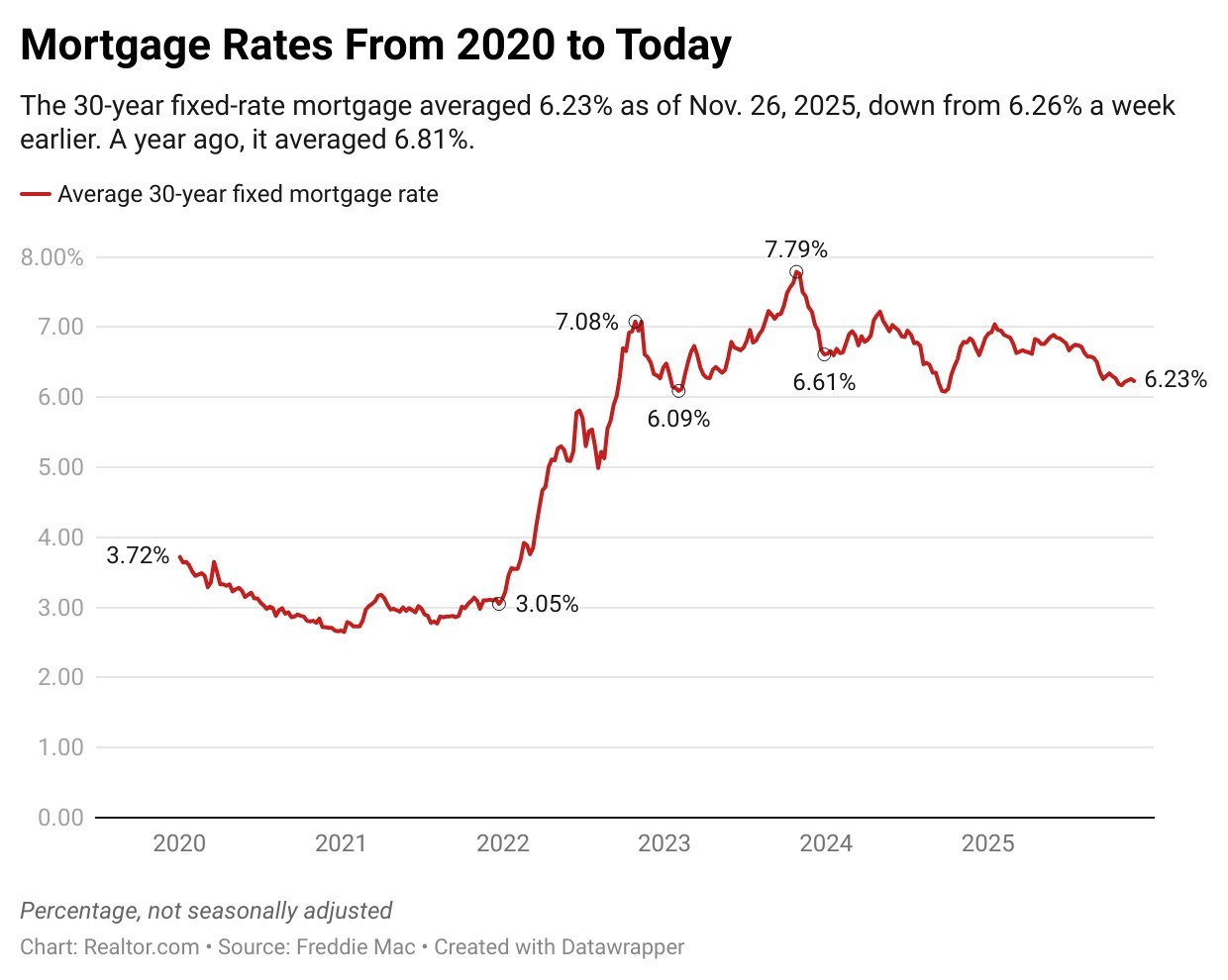

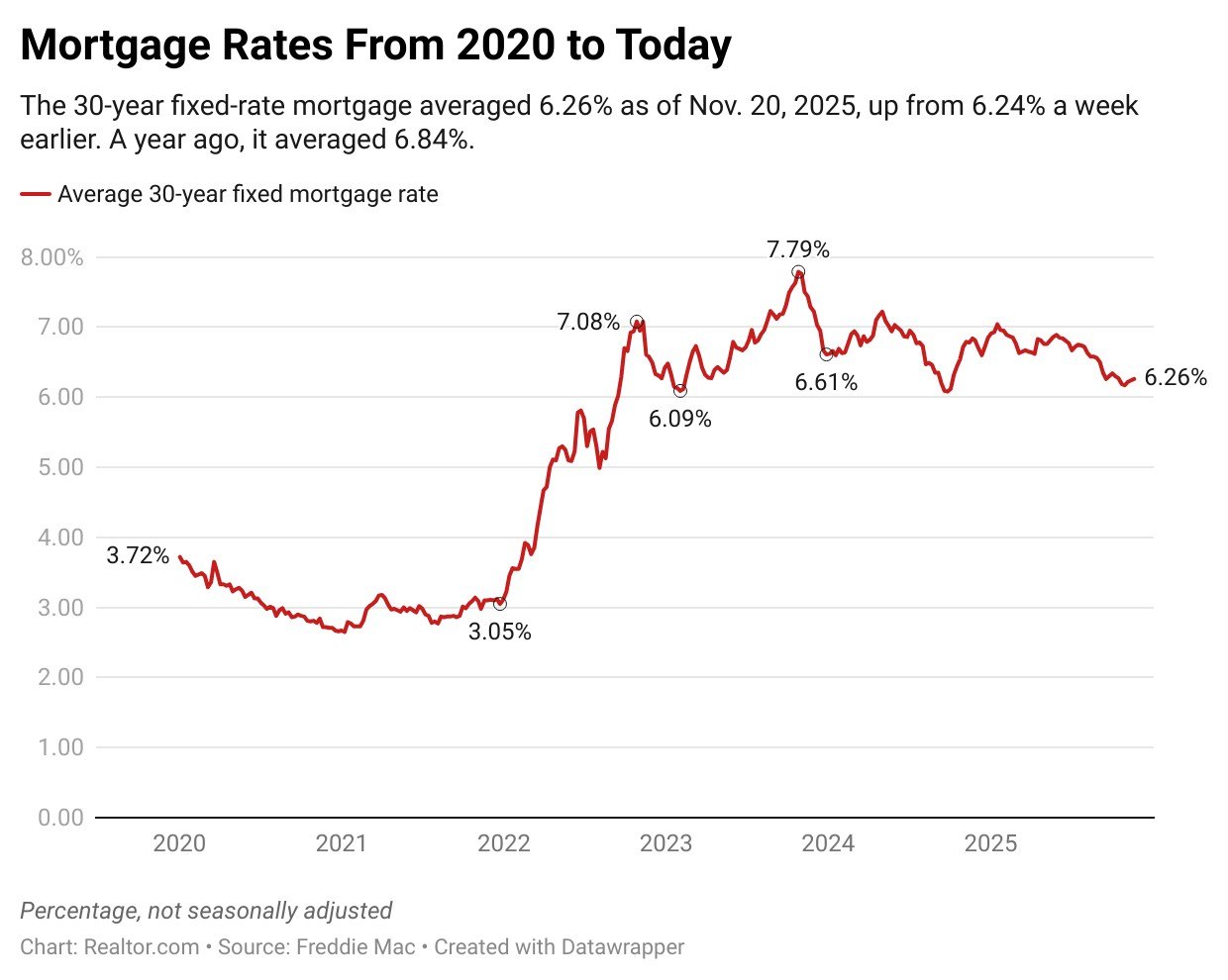

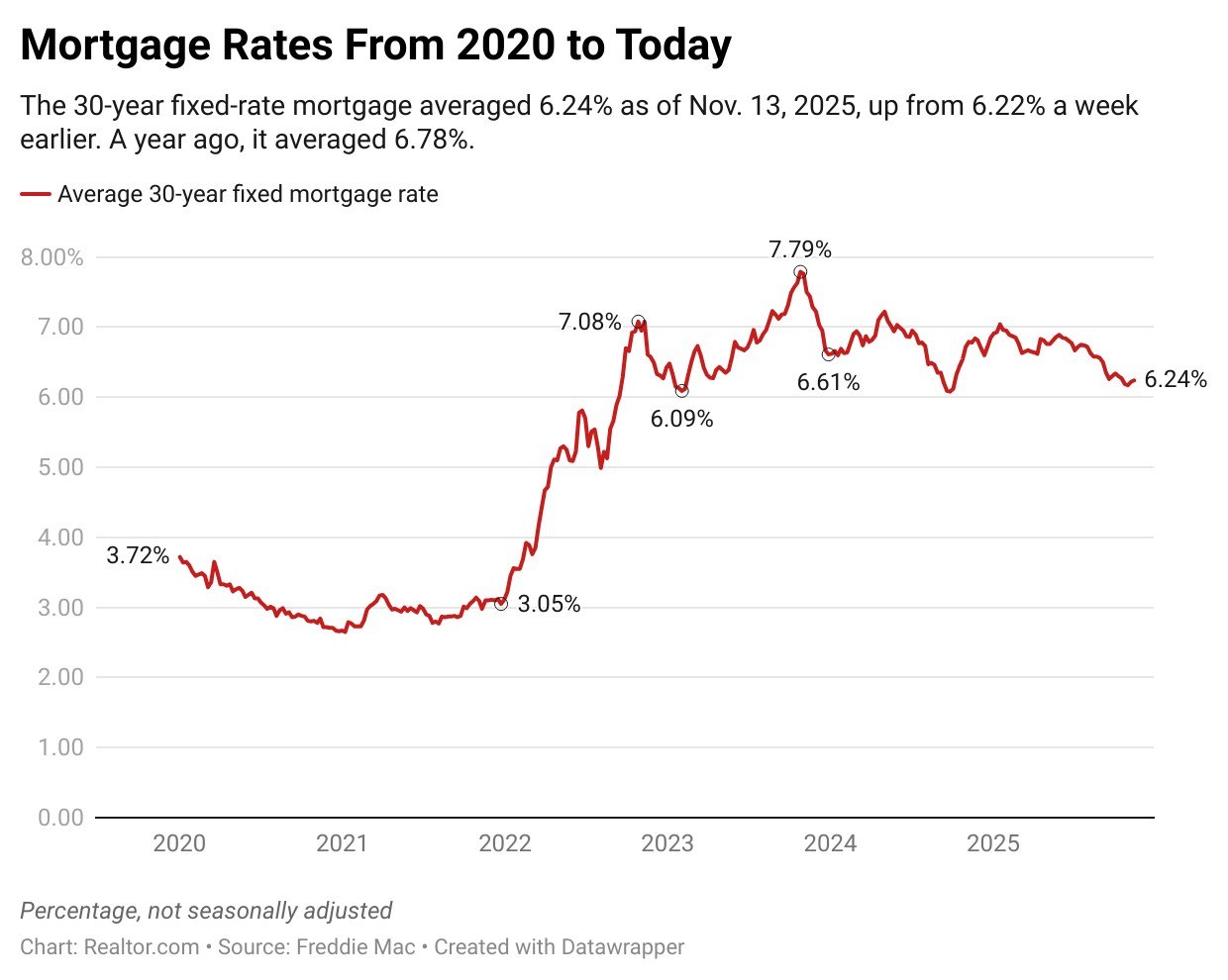

Mortgage rates will continue to average above 6% next year, but affordability will improve modestly as the typical monthly payment falls below 30% of a household’s income for the first time since 2022, the Realtor.com® economic research team predicts in its 2026 housing forecast. The forecast predicts mortgage rates will average 6.3% across 2026, a … Read more