Pending home sales remained flat in September despite a healthy decline in mortgage rates, in an early sign of continued weakness for the fall home buying season.

Signed contracts for existing homes were unchanged last month from August, and down 0.9% from a year ago, according to data released Wednesday by the National Association of Realtors®.

On a monthly basis and annual basis, pending sales declined in the Midwest and West, and rose in the Northeast and South.

Pending home sales usually lead existing-home sales by one or two months. September’s reading remained flat despite falling mortgage rates, which averaged 6.35% last month, the lowest monthly average in a year according to Freddie Mac.

“A record-high stock market and growing housing wealth in September were not enough to offset a likely softening job market,” says NAR Chief Economist Lawrence Yun. “Looking ahead, mortgage rates are trending toward three-year lows, which should further improve affordability, though the government shutdown could temporarily slow home sales activity.”

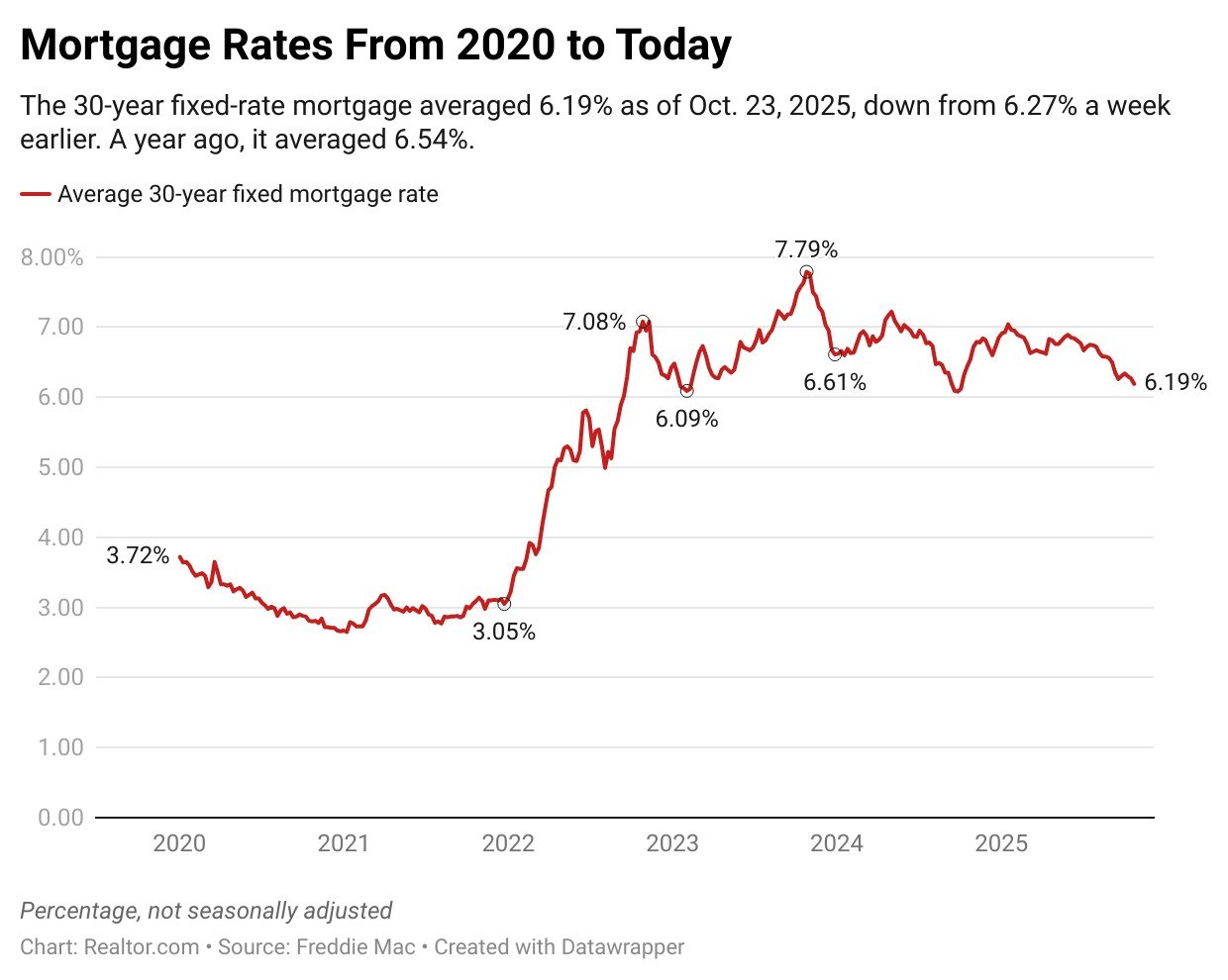

Mortgage rates have been trending lower since May, in anticipation of a new round of interest rate cuts at the Federal Reserve.

The central bank began cutting its overnight benchmark rate last month, and is expected to announce another quarter-point rate cut Wednesday afternoon.

In anticipation of the Fed’s moves, average mortgage rates reached a one-year low of 6.19% last week, down from their recent peak of 6.89% reached in May.

This 70-basis-point decline since May translates to more than $150 in monthly savings, or roughly $1,900 per year, on a median-priced home purchase, according to Realtor.com® Senior Economic Research Analyst Hannah Jones.

“With mortgage rates easing to their lowest level in over a year, more buyers could soon see the market shift from unaffordable to attainable,” says Jones. “As we move into late fall, the combination of lower rates, ample inventory, and softening prices could create a more favorable window for buyers hoping to close before year-end.”

So far, however, declining mortgage rates have primarily spurred an increase in mortgage refinancing, rather than additional home sales, according to recent data from the Mortgage Bankers Association.

Fannie Mae’s monthly consumer survey found that 73% said it was a bad time to buy in September, versus just 27% who said it was a good time to buy.

“Affordability is still a constraint even as rates have fallen to their lowest level in a year. And consumers are generally feeling more cautious amidst growing economic uncertainty,” says Bright MLS Chief Economist Lisa Sturtevant.

Miami market relevance

If this topic impacts buyers or sellers, the most useful context is what is happening locally. Track current pricing, inventory, and days on market in Miami, and compare active listings by building or neighborhood before making decisions.