Mortgage rates increased Thursday as markets awaited the release of the long-delayed employment report for September and continued to assess the latest inflation data in the wake of the government shutdown.

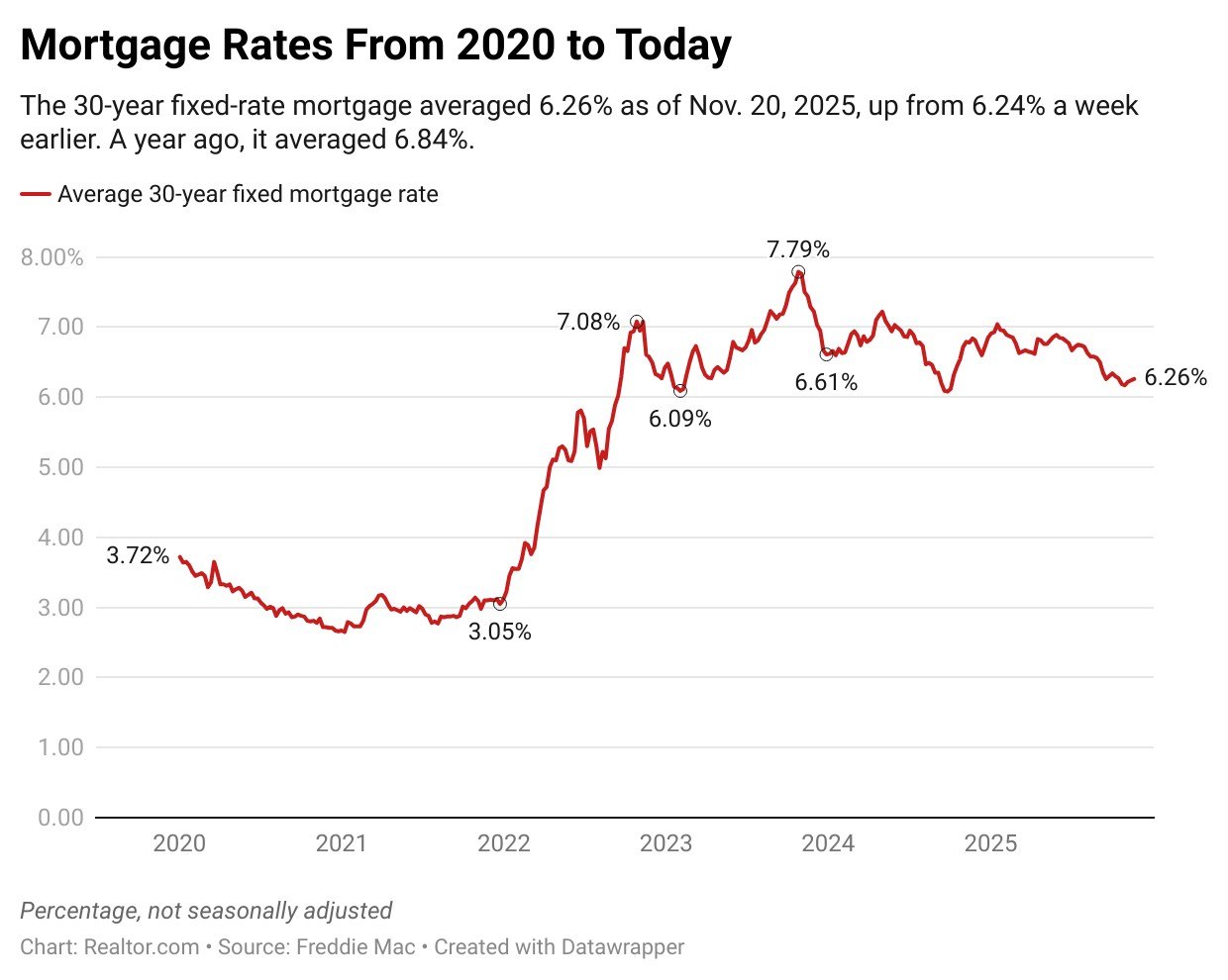

The average rate on 30-year fixed home loans edged up to 6.26% for the week ending Nov. 20, up from 6.24% the week before, according to Freddie Mac. Rates averaged 6.84% during the same period in 2024.

“Mortgage rates have been shifting within a narrow ten-basis point range over the last month. This rate stability is a positive sign for both buyers and sellers, as it helps provide greater certainty in the housing market,” says Sam Khater, Freddie Mac’s chief economist.

Treasury yields, which typically set the course for mortgage interest rates, have been volatile in recent days as investors reexamined the outlook for inflation and the timing of the Fed’s next move at the upcoming Federal Open Market Committee (FOMC) meeting scheduled for Dec. 9-10.

The central bank’s policymakers have already cut the federal funds rate twice this year by a quarter-point each, but a third reduction remains uncertain, as Fed Chair Jerome Powell made clear last month.

The overdue September jobs report that was published Thursday morning by the Bureau of Labor Statistics showed that the economy added 119,000 new jobs at the beginning of fall, exceeding economists’ predictions by a wide margin.

However, employment numbers for July and August were revised down by a combined total of 33,000 jobs.

It was also announced that a full October jobs report will not be released, but the available data will instead be rolled into the November report.

“As a result, policymakers will head into the December Fed meeting without a complete read on the job market, adding an extra layer of uncertainty to rate expectations,” says Realtor.com® Senior Economic Research Analyst Hannah Jones.

Mortgage rates remain near their lowest level in more than a year, but Jones points out that affordability continues to be strained.

While home shoppers in many markets are seeing more listings this fall, inventory levels are still low by historical standards across parts of the country.

“Sticky home prices and elevated mortgage rates continue to challenge buyers, keeping monthly payments well above pre-pandemic norms,” says Jones.

More broadly, the housing market is adjusting unevenly. Price growth has eased in some regions, like the South and West, but remains firm in others where supply is especially tight.

“With key labor and inflation data likely to be fragmented in the coming weeks, mortgage rates may remain choppy,” forecasts Jones.

How mortgage rates are calculated

Mortgage rates are determined by a delicate calculus that factors the state of the economy and an individual’s financial health. They are most closely linked to the 10-year Treasury bond yield, which reflects broader market trends, like economic growth and inflation expectations. Lenders reference this benchmark before adding their own margin to cover operational costs, risks, and profit.

When the economy flashes warning signs of rising inflation, Treasury yields typically increase, prompting mortgage rates to go up. Conversely, signs of falling inflation or weakness in the labor market usually send Treasury yields lower, causing mortgage rates to fall.

The mortgage rates you’re offered by a lender, however, go beyond these benchmarks and take some of your personal factors into account.

Your lender will closely scrutinize your financial health—including your credit score, loan amount, property type, size of down payment, and loan term—to determine your risk. Those with stronger financial profiles are deemed as lower risk and typically receive lower rates, while borrowers perceived as higher risk get higher rates.

How your credit score affects your mortgage

Your credit score plays a role when you apply for a mortgage. A credit score will determine whether you qualify for a mortgage and the interest rate you’ll receive. The higher the credit score, the lower the interest rate you’ll qualify for.

The credit score you need will vary depending on the type of loan. A score of 620 is a “fair” rating. However, people applying for a Federal Housing Administration loan might be able to get approved with a credit score of 500, which is considered a low score.

Homebuyers with credit scores of 740 or higher are typically considered to be in very good standing and can usually qualify for better rates.

Different types of mortgage loan programs have their own minimum credit score requirements. Some lenders have stricter criteria when evaluating whether to approve a loan. They want to make sure you’re able to pay back the loan.