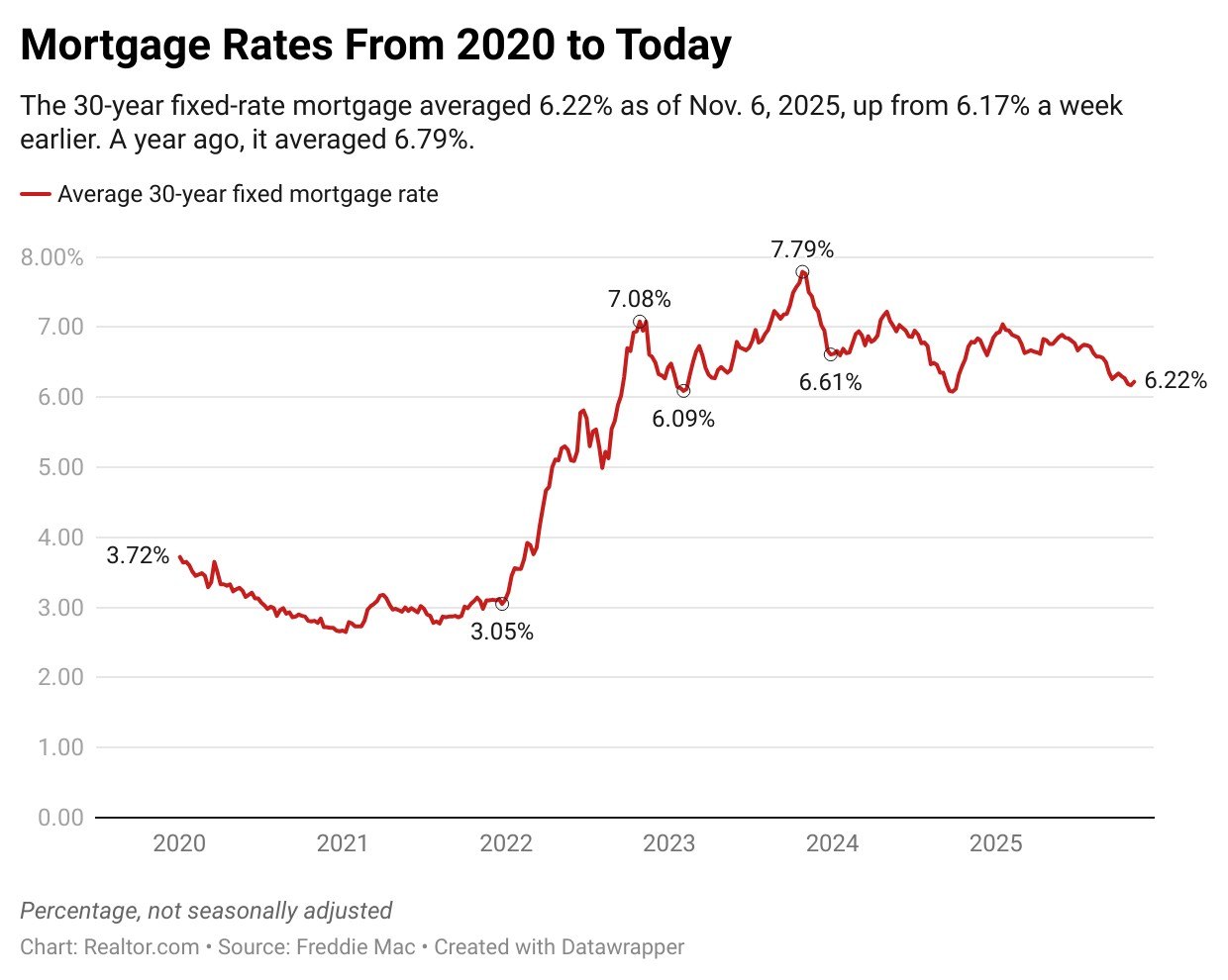

Mortgage rates climbed on Thursday after four straight weeks of declines as markets adjusted their expectations following Federal Reserve Chair Jerome Powell‘s remarks on the likelihood of future rate cuts.

The average rate on 30-year fixed home loans increased to 6.22% for the week ending Nov. 6, up from 6.17% the week before, according to Freddie Mac. Rates averaged 6.79% during the same period in 2024.

“This week, the 30-year fixed-rate mortgage averaged 6.22%,” says Sam Khater, Freddie Mac’s chief economist. “On a median-priced home, this could allow a homebuyer to save thousands annually compared to earlier this year, showing that affordability is slowly improving.”

The 5 basis-point upswing came a week after the latest Federal Open Market Committee meeting, during which the majority of central bank’s policymakers voted to cut the overnight rate by a quarter of a percentage point, down to a range of 3.75%-4%.

The year’s second pullback in the benchmark federal funds rate was widely anticipated and largely priced into the mortgage rates, but it was Powell’s comments dampening hopes for a December rate cut that set the stage for this week’s increase.

“In the committee’s discussions at this meeting, there were strongly differing views about how to proceed in December,” Powell told reporters. “A further reduction in the policy rate at the December meeting is not a foregone conclusion, far from it. Policy is not on a preset course.”

It’s worth noting that the Fed is currently making policy decisions without access to key economic data, such as unemployment numbers, due to the ongoing government shutdown, now in its second month.

Markets reacted negatively to Powell’s comments, pushing the 10-year Treasury yield higher, and mortgage rates followed, as they typically do.

“Nevertheless, mortgage rates remain well below recent highs, offering slightly improved affordability for buyers hoping to secure a home before year-end,” says Realtor.com® senior economic research analyst Hannah Jones.

In October, home shoppers in the South and West benefited from easing prices, lower mortgage rates, and ample for-sale inventory, while those in the Midwest and Northeast saw less notable signs of recovery.

Nationally, homes are still taking about two months to sell, signaling that recent rate relief has not yet been enough to motivate hesitant buyers.

“Despite the positive undercurrent of lower rates, uncertainty persists,” says Jones. “The recent government shutdown has weighed on buyer sentiment, particularly in federal-heavy markets and metros tied closely to public-sector employment.”

As the housing market moves into late fall, both buyers and sellers often turn their focus to the holidays and delay major decisions until the new year.

Still, Jones says that motivated shoppers may find a genuine window of opportunity in the coming weeks, with lower prices, more inventory, and improved rates creating favorable conditions.

How mortgage rates are calculated

Mortgage rates are determined by a delicate calculus that factors in the state of the economy and an individual’s financial health. They are most closely linked to the 10-year Treasury bond yield, which reflects broader market trends, like economic growth and inflation expectations. Lenders reference this benchmark before adding their own margin to cover operational costs, risks, and profit.

When the economy flashes warning signs of rising inflation, Treasury yields typically increase, prompting mortgage rates to go up. Conversely, signs of falling inflation or weakness in the labor market usually send Treasury yields lower, causing mortgage rates to fall.

The mortgage rates you’re offered by a lender, however, go beyond these benchmarks and take some of your personal factors into account.

Your lender will closely scrutinize your financial health—including your credit score, loan amount, property type, size of down payment, and loan term—to determine your risk. Those with stronger financial profiles are deemed as lower risk and typically receive lower rates, while borrowers perceived as higher risk get higher rates.

How your credit score affects your mortgage

Your credit score plays a role when you apply for a mortgage. A credit score will determine whether you qualify for a mortgage and the interest rate you’ll receive. The higher the credit score, the lower the interest rate you’ll qualify for.

The credit score you need will vary depending on the type of loan. A score of 620 is a “fair” rating. However, people applying for a Federal Housing Administration loan might be able to get approved with a credit score of 500, which is considered a low score.

Homebuyers with credit scores of 740 or higher are typically considered to be in very good standing and can usually qualify for better rates.

Different types of mortgage loan programs have their own minimum credit score requirements. Some lenders have stricter criteria when evaluating whether to approve a loan. They want to make sure you’re able to pay back the loan.