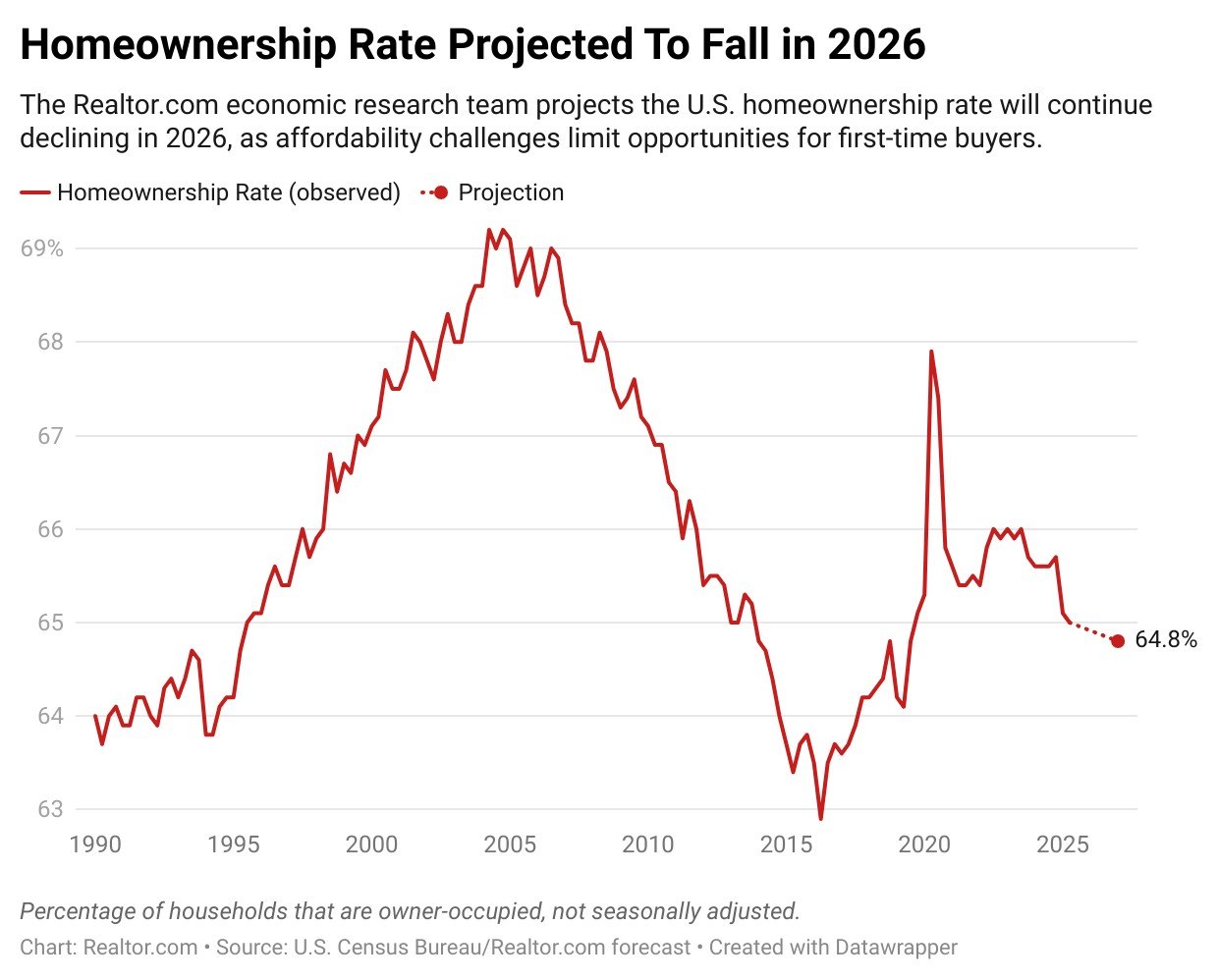

The homeownership rate in the United States is projected to fall further in 2026 after reaching a six-year low earlier this year, according to a new forecast from the Realtor.com® economic research team.

The percentage of households that are owner-occupied has trended down over the last few years, hitting 65.0% in the second quarter of 2025, the lowest since 2019, according to U.S. Census Bureau data.

Next year, that share is projected to fall to an annual average of 64.8% despite modest improvements in home affordability, the Realtor.com 2026 national housing forecast found.

“Although we expect to see the cost of buying a home decrease modestly in 2026 for the first time since 2020, rents are also expected to decline,” says Realtor.com Chief Economist Danielle Hale. “This means that potential first-time homebuyers trying to decide whether to buy or rent will find that renting offers significant near-term savings in most housing markets.”

As well, down payments are expected to remain near recent highs in 2026, presenting a significant hurdle for those prospective first-time buyers, a group that tends to be younger and with less savings to tap, says Hale.

Investors also remain active in the housing market, accounting for more than 10% of recent homebuyers, according to a Realtor.com analysis.

It’s important to note that the homeownership rate as measured by the census is not the share of adults who own a home, but rather the share of households that are owner-occupied.

That means adults who live in a home owned by a family member or roommate simply don’t appear in the calculation—they are part of an “owner-occupied household.”

Still, the census figures offer an insight into how the relative share of renters versus homeowners has changed over time, with demographic trends and housing costs playing a major role.

In data going back to 1965, the homeownership rate hit an all-time high of 69.2% in 2004, as the average Gen Xer hit their mid-30s and most of the millennial generation still lived at home.

Homeownership dropped precipitously after that as the massive millennial generation hit adulthood in the middle of the global financial crisis and housing market collapse, delaying homeownership for many of that generation.

The homeownership rate hit an all-time low of 62.9% in 2016, and then began to climb as millennials hit their 30s.

The rate spiked sharply in 2020 as the COVID-19 pandemic both delayed household formation for Gen Z and spurred a brief frenzy of millennial homebuying. Since then, homeownership has fallen as affordability weighs on first-time homebuyers, locking many out of the market.

This year, the median age of first-time homebuyers hit an all-time high of 40, while the typical repeat homebuyer is now 62, also the highest on record, according to a recent report from the National Association of Realtors®.

Affordability remains a key struggle for first-time buyers, with home prices at record highs and elevated mortgage rates adding to the cost of purchasing.

Next year, affordability is expected to improve modestly as mortgage rates ease toward 6.3% and incomes rise faster than home prices, according to the new Realtor.com national forecast.

That slight improvement could coax some prospective homebuyers off the fence, but the forecast expects that effect to be outweighed by softer rent prices, making renting relatively more affordable, particularly for Gen Z members hitting adulthood.

“Already, homeownership rates for younger households have declined more than the homeownership rate overall, and once this trend is underway, it’s hard to stop,” says Hale.

Currently, Gen Z members are 13 to 28 years old, having been born from 1997 to 2012. This year, members of Gen Z accounted for just 3% of all home purchases, according to a NAR survey.

A recent Realtor.com survey of Gen Z adults who currently own or hope to own a home found that 82% of respondents believe it’s harder for their generation to buy a home compared with previous ones.

As well, 16% say housing affordability is among their highest concerns, and only 36% feel financially ready to buy a home.

“Fortunately, improving affordability in the housing market is expected to lead to home sales growth in 2026, and while we’ll still see the overall homeownership rate slip further, I expect that the decline will slow as younger households find their footing and begin to find ways to navigate these challenges,” says Hale.

Miami market relevance

If this topic impacts buyers or sellers, the most useful context is what is happening locally. Track current pricing, inventory, and days on market in Miami, and compare active listings by building or neighborhood before making decisions.