Homebuyers and real estate investors are always on the hunt for a deal, and some areas throughout the country are offering incentives.

Currently, 8,764 places have been deemed Opportunity Zones across the U.S. They’re federally designated census tracts where certain investments may qualify for tax incentives under the 2017 Tax Cuts and Jobs Act.

“These zones allow investors to receive substantial capital gains tax breaks in exchange for placing funds in underserved communities,” Chad D. Cummings, CPA and attorney, tells Realtor.com®.

But with so many zones to choose from, which is the best investment?

Prices increased year over year in 54.6% of zones with enough data to analyze, according to a new Opportunity Zones Report by ATTOM, a leading curator of land, property data, and real estate analytics.

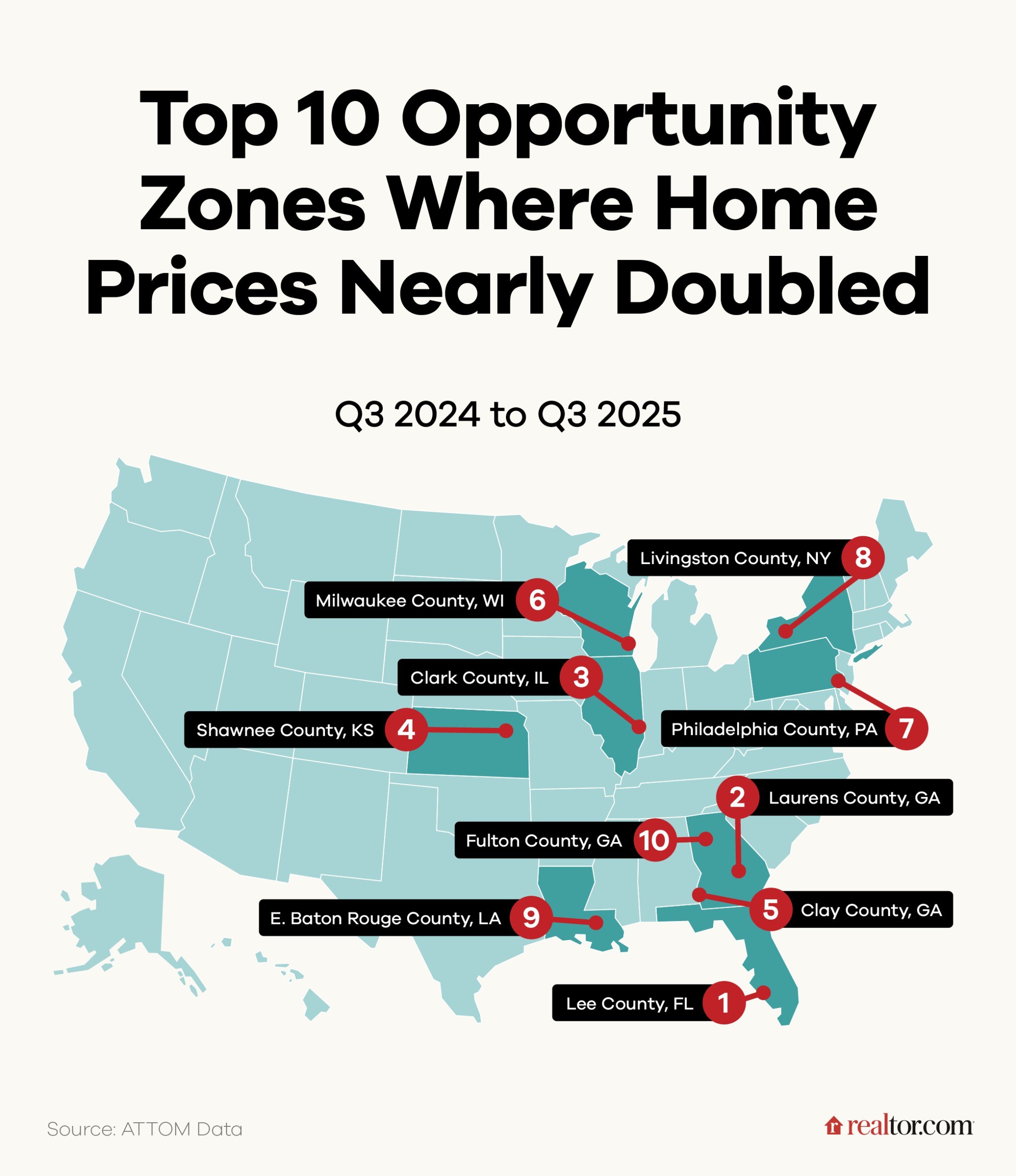

And in the top 10 Opportunity Zones, home prices have nearly doubled.

Topping ATTOM’s list are Lee County, FL (+97.8%), Laurens County, GA (+97.2%), Clark County, IL (+96.7%), Shawnee County, KS (+95.7%), Clay County, GA (+95.6%), Milwaukee County, WI (+95.6%), Philadelphia County, PA (+95%), Livingston County, NY (+94.3%), East Baton Rouge County, LA (+93.8%), and Fulton County, GA (+93.6%).

“Overall, these counties represent areas where low baseline home values combined with favorable local dynamics to drive outsized price gains,” explains Hannah Jones, senior economic research analyst at Realtor.com.

The zones are distributed across multiple U.S. regions, including the South, Midwest, and Northeast.

“While both the Midwest and Northeast have shown broad strength in home prices, parts of the South have experienced some price softening,” says Jones. “Even so, this data highlights that within these counties, specific Opportunity Zones have seen substantial appreciation despite broader market headwinds.”

Several Opportunity Zones are also located in states “characterized by strong population and economic growth compared to higher-priced coastal markets,” she adds.

Hottest Opportunity Zones

Real estate agent and investor Ron Myers, of Ron Buys Florida Homes, says that he’s been doing a lot more business in Lee County, FL, this year.

Even though the zone tops the list for price growth, Myers tells Realtor.com, “home prices are still lower compared to other popular areas in Florida”—which makes it more attractive to buyers.

“I have more buyers asking about Lee County, especially since it is in an Opportunity Zone,” says Myers. “These zones give investors big tax breaks, like putting off taxes on profits or saving money if they hold the property long enough—which is a big reason why investors are looking to buy there.”

Georgia has three Opportunity Zones in the top 10—more than any other state.

“Georgia stands out as a generally favorable state for investors, offering attractive conditions for rental income and long-term appreciation thanks to its growth trajectory and relative affordability,” says Jones.

However, outcomes are far from guaranteed.

“Investment success in Georgia depends heavily on the specific county or metro area, property type, entry price, and overall investment strategy,” Jones adds.

While strong appreciation is possible, “investors need to be selective and evaluate each area closely, rather than assume automatic high returns,” Rob Barber, CEO of ATTOM, tells Realtor.com.

“Some Opportunity Zones did see sharp price jumps. However, the broader report finds that Opportunity Zones overall grew at a pace similar to non-Opportunity Zones areas, meaning those outsized gains are the exception, not the rule.”

Prices are on the rise

Median home prices rose year over year in more than half (54.6%) of Opportunity Zones with enough data to analyze, according to ATTOM.

In the third quarter of 2025, 11.3% of Opportunity Zones recorded their highest median home price since the Great Recession in 2008.

In addition, median home prices rose by at least 10% year over year in 36.2% of the zones with sufficient data.

“Opportunity Zones were just as likely to see home prices grow as neighborhoods outside these zones, showing these areas are also benefiting from this sustained rise in home prices,” says Barber. “But many of these zones still have a long way to go, since their median sales prices are well below areas that haven’t been targeted for development.”

Affordability meets opportunity

The report notes that “homes inside Opportunity Zones remain far more affordable.”

ATTOM found that only 20% of Opportunity Zone tracts had a typical home price above the national median of $370,000.

In fact, in the third quarter of 2025, 49.9% of the Opportunity Zone census tracts reported median sales prices below $225,000.

This means “investors can enter at more affordable price points while still capturing potential upside,” says Barber.

Most Midwestern Opportunity Zones (54%) had median home values below $175,000, compared to 38% in the Northeast, 37% in the South, and 5% in the West.

Opportunity Zones with the lowest median home values saw the weakest price gains, as only 39.7% of those with a median sales price below $125,000 recorded year-over-year growth.

One of the exceptions was Shawnee County, KS, which ranked fourth on the list.

Its median sales price skyrocketed from $45,065 to $88,213 year over year.

Ben Allgeyer, a Kansas-based real estate investor and the property specialist at Fast Kansas City Home Buyers, says that Shawnee County is hot with investors.

“There’s been a population increase that needs housing, with a focus on rentals,” he says. “With increased employment opportunities in the county, the demand for midpriced units continues.”

Allgeyer says investing in Opportunity Zones like the one in Shawnee County offers “the community an opportunity for new jobs, enhanced economic growth, and rehabbing and renewing blighted areas.”

And the tax write-off doesn’t hurt either.

“That’s the main reason many private investors participate in the projects offered by the zone program,” he admits.

1. Lee County, FL

- Third-quarter 2024 median sales price: $450,000

- Third-quarter 2025 median sales price: $890,000

2. Laurens County, GA

- Third-quarter 2024 median sales price: $90,000

- Third-quarter 2025 median sales price: $177,449

3. Clark County, IL

- Third-quarter 2024 median sales price: $75,000

- Third-quarter 2025 median sales price: $147,500

4. Shawnee County, KS

- Third-quarter 2024 median sales price: $45,065

- Third-quarter 2025 median sales price: $88,213

5. Clay County, GA

- Third-quarter 2024 median sales price: $80,500

- Third-quarter 2025 median sales price: $157,451

6. Milwaukee County, WI

- Third-quarter 2024 median sales price: $135,000

- Third-quarter 2025 median sales price: $264,000

7. Philadelphia County, PA

- Third-quarter 2024 median sales price: $100,000

- Third-quarter 2025 median sales price: $195,000

8. Livingston County, NY

- Third-quarter 2024 median sales price: $87,606

- Third-quarter 2025 median sales price: $170,250

9. East Baton Rouge County, LA

- Third-quarter 2024 median sales price: $80,000

- Third-quarter 2025 median sales price: $155,000

10. Fulton County, GA

- Third-quarter 2024 median sales price: $162,387

- Third-quarter 2025 median sales price: $314,447