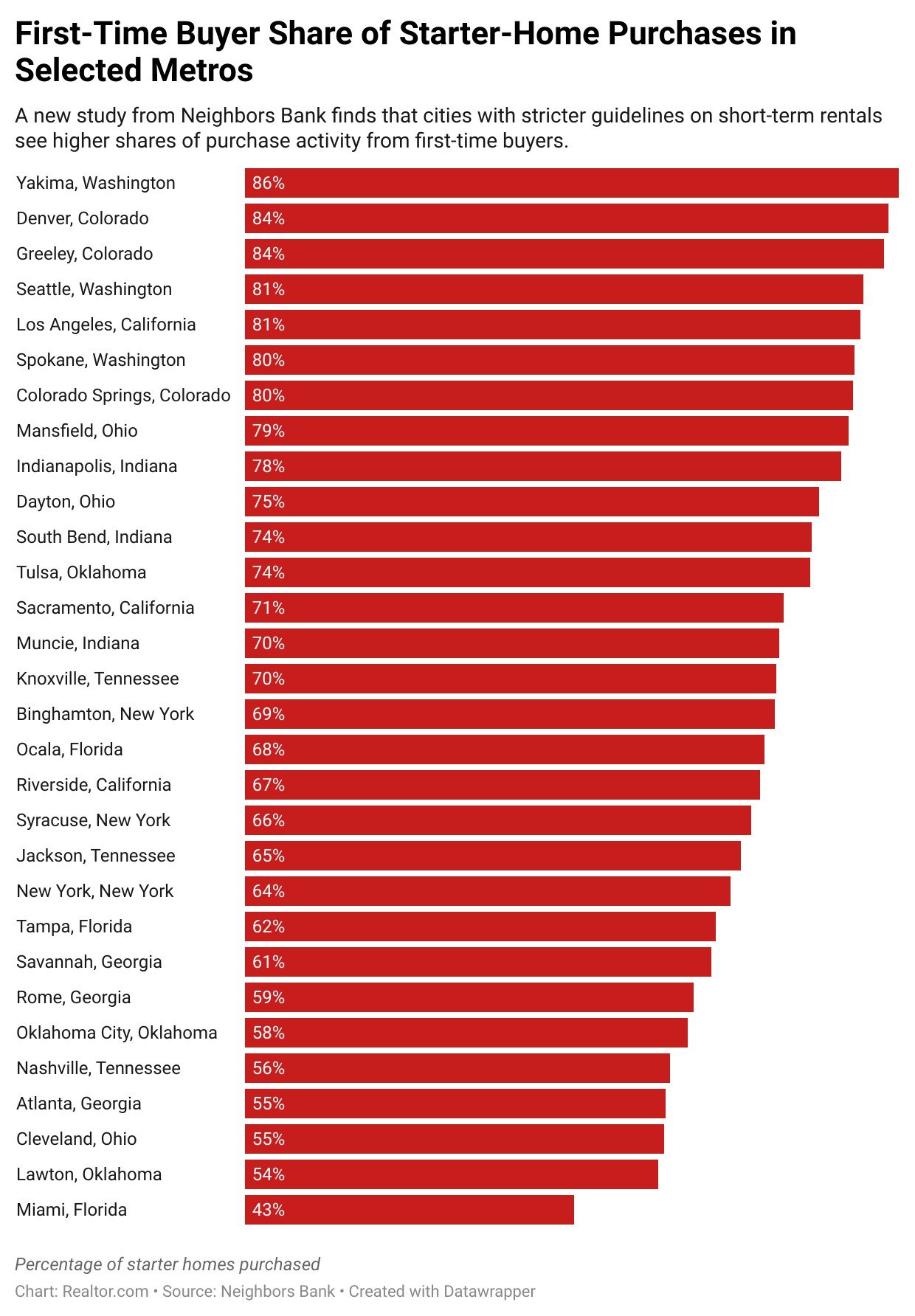

Among major metro areas, first-time homebuyers hold the biggest advantage over investors in Denver, where strict rules on short-term rentals limit the upside for speculative buyers, according to a new analysis.

Nationally, first-time buyers accounted for about 69% of all starter-home purchases last year, while investors snapped up 31% of the properties, the analysis from Neighbors Bank showed.

In Denver, where the median home listing price was about $495,000 last month, first-time homebuyers accounted for an impressive 84% of starter-home purchases, leaving investors with just 16%.

Meanwhile in Miami, where the median home price is $499,000, investors have a much bigger edge, accounting for 57% of all starter-home purchases, leaving first-time buyers with just 43%.

The report attributes this difference to local regulations, with Denver strictly limiting short-term rentals, while Florida state law prohibits such bans, allowing investors to freely convert homes into vacation rentals.

“Affordability doesn’t exist in a vacuum,” says Jake Vehige, president of mortgage lending at Neighbors Bank. “Two cities with similar home prices can have completely different outcomes depending on how they regulate investor activity and protect owner-occupants.”

To measure first-time buyer share, the new study used federal mortgage data from 2024, and thus excludes cash purchases. The analysis is focused on starter homes, defined as properties affordable on a budget of 30% of the local median income.

Where first-time buyers are doing the best

In addition to Denver, the study found that first-time buyers are grabbing a significant share of starter homes in Seattle, Los Angeles, Indianapolis, and Dayton, OH.

In Seattle, first-time buyers claimed 81% of starter homes, thanks to limits on short-term rentals that make it difficult for investors to build a large portfolio.

Seattle laws allow each host a maximum of two rentals, and one must also be their primary residence, a measure that limits large investors and creates more room for first-time buyers.

In Los Angeles as well, first-time buyers accounted for 81% of purchases, with a combination of city ordinances and state laws helping protect owner-occupants.

At the city level, Los Angeles restricts STRs to an owner’s primary residence, reducing investor conversions of affordable housing into vacation rentals. A state law also gives tenants, nonprofits, and owner-occupants a 45-day window to match investor bids on foreclosed homes.

In Indianapolis, 78% of starter-home purchases were made by first-time homebuyers, with the Midwest city’s affordability playing a major role.

As well, a number of local initiatives in Indianapolis prioritize the sale and redevelopment of properties to owner-occupants, steering vacant and abandoned homes away from speculative investors.

And in Dayton, local programs also contribute to a healthy first-time buyer share of 75%. One initiative from the Montgomery County Land Bank helps low-income buyers purchase a home, with deed restrictions requiring owner-occupancy.

Where investors have the upper hand

Investors hold the biggest share of starter-home purchases in Miami, where state preemptions of any STR bans create a free-for-all environment for investors.

Additionally, investors control relatively large shares of the market in Cleveland (45%), Atlanta (45%), Nashville (44%), and Oklahoma City (42%).

These markets typically have few restrictions on STRs, with no limits on the number of properties an investor can purchase for use as vacation rentals.

However, Cleveland recently passed a comprehensive housing package that requires rental properties to register with the city, obtain certificates of rental occupancy, and meet certain safety standards, which could help temper investor demand in that city.