Florida Gov. Ron DeSantis is pushing to eliminate property taxes on homeowners in the state, but a new analysis suggests the move would come at a heavy price for renters and first-time homebuyers.

DeSantis has argued that taxes on homeowners are oppressive and fuel wasteful spending by bloated local governments.

“Property taxes effectively require homeowners to pay rent to the government,” he said earlier this year.

If property taxes were eliminated outright on owner-occupied homes in Florida, property values in the state would immediately jump by about 7% to 9%, according to a new analysis from the Realtor.com® economic research team.

This would boost the aggregate value of Florida’s owner-occupied housing stock by about $200 billion to $250 billion, creating an immediate windfall for current homeowners, but only at the expense of future first-time buyers.

“It would be a boon to existing property owners,” says Realtor.com senior economist Joel Berner, who conducted the analysis. “But this measure would disproportionately benefit wealthy Floridians at the expense of those who don’t own homes, and would make it even harder to break into homeownership because of the increased prices.”

But one may ask, what do property taxes have to do with home prices?

There is extensive research demonstrating that the future expenses of owning a home, including property taxes, are capitalized into the home’s present value. Reducing those expenses boosts that present value, all else being equal.

Of course, the exact impact of property tax reform on home values is difficult to gauge and would depend on the specifics of the plan approved by voters, as well as any unforeseen impacts on supply or demand.

But the new analysis, based on a user-cost model with certain assumptions about property tax capitalization, is the first to estimate the immediate impact of a sweeping elimination of Florida’s property taxes on the state’s housing market.

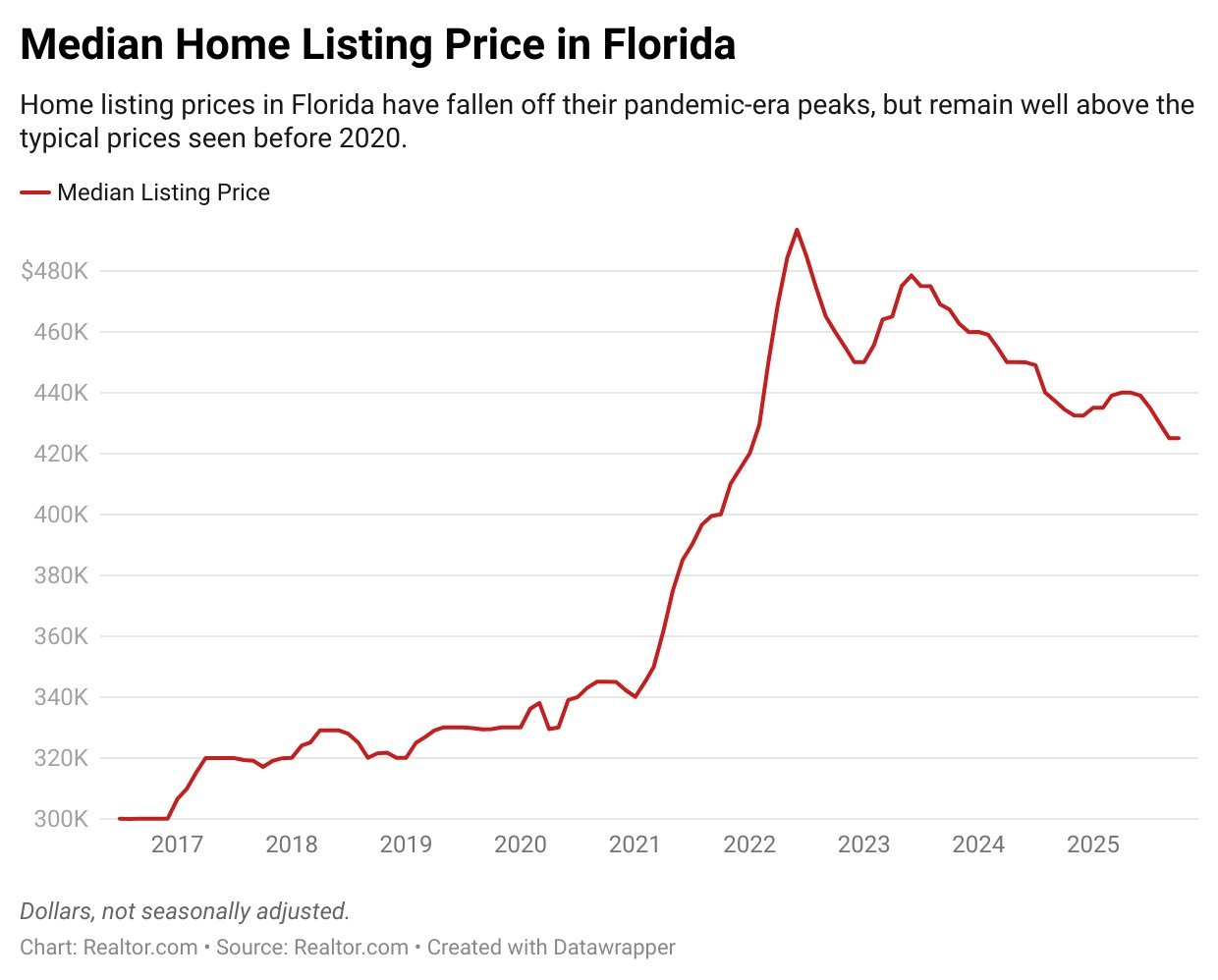

After several years of softening home prices in Florida, an upward jolt may be welcome news to homeowners there, especially those who purchased at the peak prices of the COVID-19 pandemic-era boom.

In October, Florida home values were down about 3% from the same month in 2022, as measured by Realtor.com data on listing prices per square foot. But compared with October 2019, those values are still up 42%, an increase that has outpaced incomes, straining affordability for first-time buyers.

Median home listing prices have fallen further off their peak than price per square foot, perhaps due to a surge in condo listings. In October, Florida’s median listing price was $425,000.

Why DeSantis wants to eliminate property taxes

For months, DeSantis has called for property taxes on homeowners to be reduced and ultimately eliminated through an amendment to the state’s constitution.

“Truly owning private property should not mean perpetually paying rent to the government,” he wrote on X in May. “I’m committed to reducing—and ultimately eliminating—property taxes for homeowners in Florida.”

DeSantis argues that the tax burden on homeowners could be picked up through the state’s taxes on retail sales and corporate income, as well as property taxes on second homes, rentals, and commercial properties, which would not be exempt under his plan.

The proposal has found support among many Florida homeowners, who have struggled with rising expenses, including higher tax bills and soaring insurance costs. And some argue that those costs, including property taxes, are yet another barrier to homeownership.

But critics argue that the plan could leave Florida’s schools, local infrastructure, and emergency services underfunded, reducing the quality of life in the state.

As well, rental properties would not be immune from property taxes under DeSantis’ proposal, and any additional taxes on landlords would likely be quickly passed along to tenants in the form of higher rents.

“This would be a highly regressive tax, placing more of the state’s tax burden on renters, whose units are still being taxed, and those taxes are passed along to tenants,” says Berner.

Currently, there are seven proposed constitutional amendments in the Florida state Legislature related to property tax reform that, if approved by the Legislature, would appear on the 2026 ballot.

Some of those proposals advocate for eliminating all nonschool property taxes on homeowners, but would eliminate other property taxes that go toward local governments and water districts.

Assuming that school taxes account for 35% of all property taxes in Florida (a rough guess, as statewide averages are not available), Berner estimates that eliminating other property taxes would boost property values by 4% to 5.5%, representing a $110 billion to $150 billion increase in the total value of Florida’s owner-occupied housing stock.

However, DeSantis has been critical of the seven proposals, in part because he favors putting a single amendment in front of voters. In his public remarks, he has advocated for the total abolition of property taxes on homesteads.

A spokesperson for DeSantis did not respond to a request for comment from Realtor.com.

Economist warns of a ‘black swan’ event

Ken Johnson, a housing economist and the Christie Kirkland Walker Chair of Real Estate at the University of Mississippi, believes that eliminating property taxes would boost Florida’s ailing housing market in the short term.

However, he sees other risks for the state further down the road if Florida moves forward with DeSantis’ plan.

Johnson shared concerns that the state could face a combined budget crisis and housing market collapse if a national recession hits and drives widespread sales of second homes in Florida.

With no state income tax in Florida, eliminating property taxes on homesteads would further narrow the tax base there, akin to putting all the state’s revenue eggs in one basket, says Johnson.

“As long as we are in a prosperous economic time, not in a recession, all of this is going to work fine,” says Johnson. “The risk that Florida is exposed to is that once we hit a recession, we’re probably going to see an excess supply of homes go on to the market.”

That’s because of Florida’s huge concentration of vacation homes, which account for around 10% of the state’s housing stock, and would not be immune to property taxes under DeSantis’ proposal.

If a national recession hit, Johnson predicts many of those homes would be put up for sale, creating a supply glut that would ultimately push home prices down.

“The ‘black swan’ event becomes: recession has hit. Real estate prices are going down. So are tourism dollars. So is taxation from out-of-state homeowners with either short-term rentals or second homes,” he says. “A major U.S. recession could crash Florida housing and, at the same time, dry up the Florida budget.”

That scenario, however, could be years down the road, depending on when the national economy next takes a sharp downturn.