The Federal Reserve has announced its second interest rate cut in a row, easing monetary policy as concerns grow about rising layoffs and economic fallout from the government shutdown.

Fed Chair Jerome Powell joined the majority of the Federal Open Market Committee (FOMC) to vote for the quarter-point rate cut at Wednesday’s meeting in Washington DC.

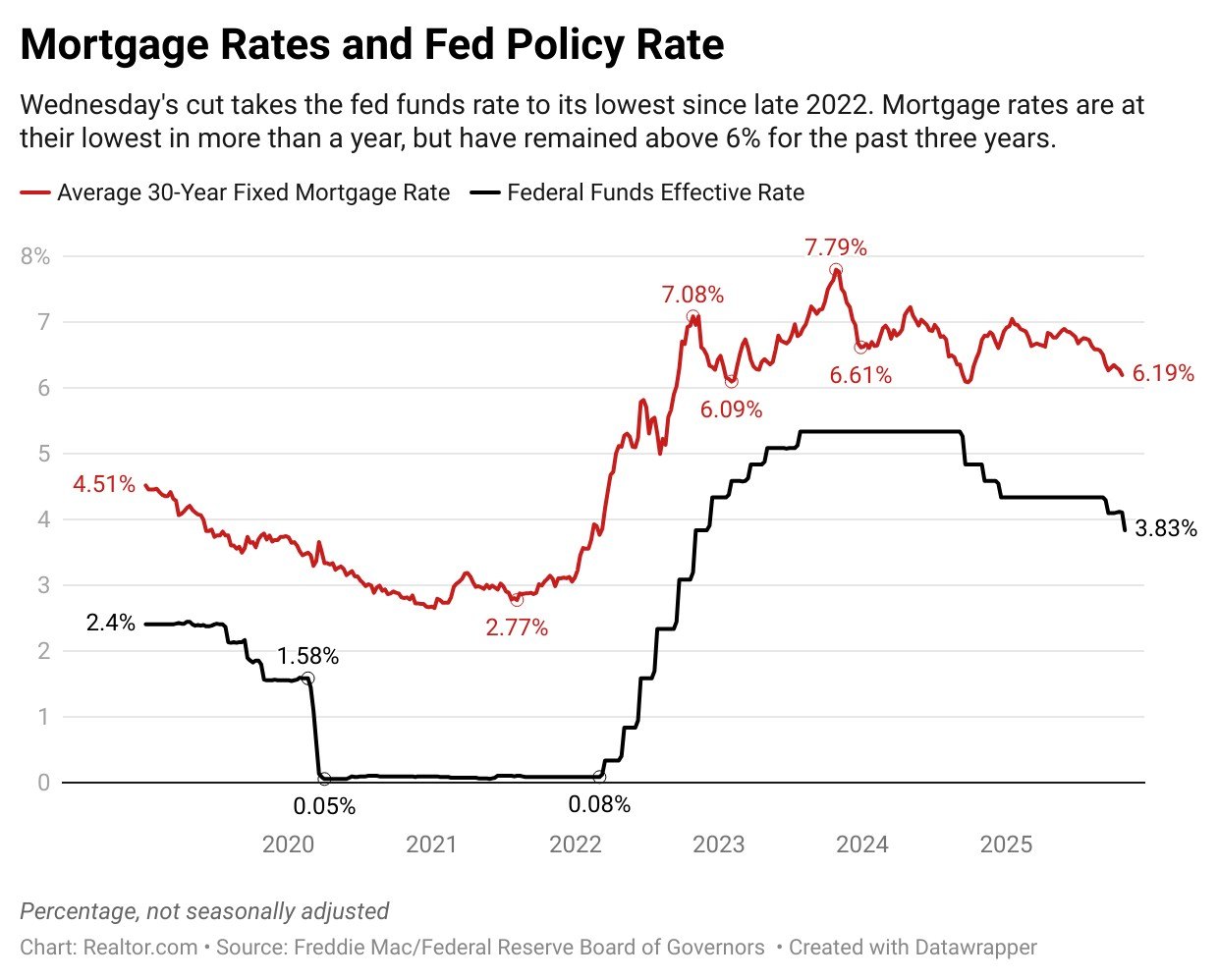

The move takes the central bank’s overnight rate down to a range of 3.75% to 4%, marking the lowest federal funds rate since late 2022. The next FOMC meeting will be held in December.

Today’s quarter-point cut was widely anticipated and already largely priced into mortgage rates, which have fallen in recent months and reached a one-year low of 6.19% last week, according to Freddie Mac.

However, the Fed’s decision on Wednesday doesn’t mean mortgage rates will automatically fall further, and the bond market’s reaction to Powell’s commentary at a 2:30 p.m. press conference will provide key clues about where mortgage rates go next.

“Mortgage rates have moved down notably in advance of the Fed’s meeting, hitting their lowest level in more than a year, but further declines will depend on new developments,” says Realtor.com Chief Economist Danielle Hale. “The Fed’s decisions are anticipated by the market, which means that the upcoming rate cut and several more over the next few months are already largely priced in.”

While some outside economists have suggested that the Fed could directly intervene in the secondary mortgage market to lower mortgage rates, Powell has firmly rejected this idea, and is seen as unlikely to budge on the issue.

The Fed does not set mortgage rates directly, and instead sets the short-term rate for overnight lending between commercial banks. Still, expectations about future Fed policy and general financial conditions can influence long-term rates, including mortgage rates.

The Fed uses higher interest rates to combat inflation, and lower interest rates to stimulate the labor market, in line with its dual mandate of price stability and maximum employment.

The two sides of that mandate have been in increasing tension in recent months, with inflation ticking higher and signs of weakness in the labor market, presenting Fed policymakers with a challenging dilemma.

But after years of focusing on reigning in inflation, Fed policymakers have increasingly shifted their focus to the labor market in recent months, after a series of jobs reports that indicated softening conditions.

Mounting layoffs raise concerns about the labor market

In recent days, a number of major employers announced significant layoffs that could heighten the risk of an economic downturn, bolster the case for further Fed rate cuts.

Just this week, Amazon announced the layoff of 14,000 corporate employees as the company shifts resources to invest in AI, while UPS confirmed that it expects to cut 48,000 jobs by the end of this year.

Target also sent roughly 1,000 layoff notices to corporate staff, in a bid to boost profits after years of stagnant sales, and media giant Paramount initiated staffing cuts also close to 1,000.

The layoff announcements have taken on outsized significance in the FOMC deliberations after October’s jobs report was suspended due to the ongoing government shutdown.

Although there are private data sources that track employment, they are considered more limited and less reliable than the official government reports.

Fed policymakers acknowledge that they have increasingly turned to anecdotal sources in the absence of hard federal employment data.

“To deal with this lack of public data, I spend a lot of my time talking to business contacts, whose views help me form my outlook for the economy,” Fed Gov. Christopher Waller said in recent comments at the Council on Foreign Relations in New York.

Developing story, more to follow.