Buyer satisfaction among homebuyers has improved over the last two years as the housing market’s slower pace has given house hunters more time to plan for homeownership.

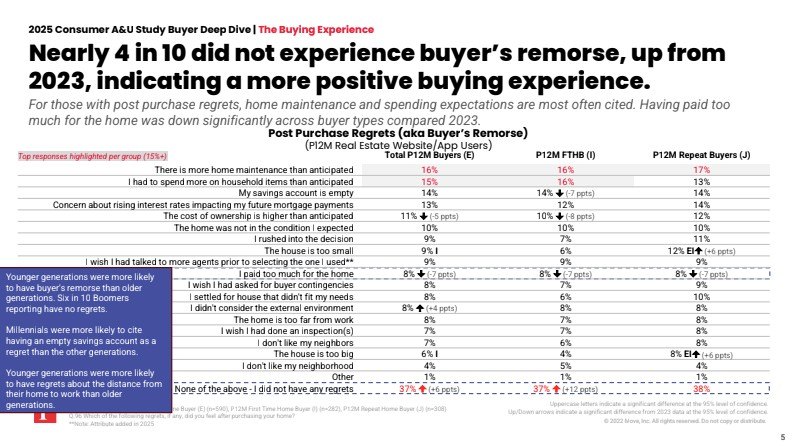

In 2025, nearly 4 in 10 homebuyers (37%) said they did not experience regret over their purchase, up from 31% in 2023, according to the Realtor.com® 2025 Consumer Attitudes & Usage Study.

As part of the study, researchers at MarketVision Research in February surveyed 1,267 respondents who had acquired a home in the last 12 months.

One of the most common complaints among homebuyers—feeling like they overpaid for their new dwelling—saw a major dip, declining from 15% in 2023 to just 8% this year, the survey found.

The reason for this dramatic shift, according to researchers, is that the market has cooled, with the typical for-sale home waiting for a buyer 63 days as of October, nearly two weeks longer than two years ago, according to the monthly housing market trends report from Realtor.com.

Laura Eddy, Realtor.com vice president of research and insight, explains that during the pandemic, the housing market heavily favored sellers and moved at a breakneck speed, leaving buyers feeling rushed to put in an offer as quickly as possible, or risk losing out.

In that environment, Eddy says there was little time to stop and weigh the consequences of homeownership, which increased the likelihood of post-purchase buyer’s remorse.

“As the market has shifted to be more of a buyer’s market and some of those pressures have alleviated, the buyer … has more time to think through implications,” says Eddy. “They don’t necessarily have to, or they don’t feel like they have to put in an offer the first time they see a house.”

Today’s buyers do not feel pressured to bid over asking price without considering what they can actually afford, and, in fact, they are more likely than before to ask sellers for concessions.

Additionally, Eddy notes that homebuyers in 2025 are better prepared than ever, venturing into the market with their finances in order, credit scores improved, and down payments saved up.

Home maintenance tops lists of gripes

Among the new homeowners who did experience pangs of buyer’s remorse, the most common complaint was having to deal with more home maintenance than expected, with 16% of respondents citing that issue.

The second-biggest regret was spending more money on household items than anticipated, at 15%, followed by being left with a depleted saving account post-purchase, at 14%.

Other major sources of frustration among homebuyers included a higher-than-expected cost of homeownership (11%), rising interest rates (10%), and the home being not in the condition the buyer had expected (9%).

Overall, however, more new owners reported having positive feelings like satisfaction and joy about their buying process, while negative emotions, such as anxiety, frustration, and annoyance, have all waned since 2023.

Generational divide

Regret among buyers varied dramatically by age, with older, often more experienced, homebuyers feeling the most confident and younger buyers being the most likely to be overcome by remorse after move-in day.

Among baby boomer respondents, 60% reported no homebuying regrets, compared with just 45% of Gen X buyers.

Meanwhile, only about a third of millennials were spared buyer’s remorse, with their top concerns being their vanishing savings, elevated maintenance costs, and unplanned expenses.

Across all age groups, Gen Z buyers were the least confident about their purchasing decisions, with just 27% of them reporting zero regrets.

The younger buyers were most concerned about skipping inspections, higher ownership costs, and household spending.

Newly minted Gen Z homeowners were also more likely to have gripes about commute distances and neighborhood choices.

Eddy says the generational gap comes down to experience: Baby boomers and Gen X buyers were more likely to have gone through the process of purchasing property in the past and know what to expect, while many of their younger counterparts are navigating it for the first time, leaving them more susceptible to pitfalls and disappointments.

On top of that, Gen Z buyers are more likely to struggle with affordability, forcing them to make trade-offs they might later come to regret, such as choosing a smaller home they would have liked, or one with a longer than desired commute.

“The boomers and Gen Xers of the world, not only have they been through the process before, but they’ve had equity built up potentially in another home,” adds Eddy. ”They’ve had more of their life to save money, and they don’t necessarily have to make some of those trade-offs.”

Sarah Coffer, a strategic marketing consultant, adds that another important factor is that Gen Z buyers have the highest rate of rejected mortgage applications, leaving them feeling frustrated.

According to the authors of the study, the findings signal a shifting buyer psychology fueled by a changing market. In this more slow-paced environment, a growing number of home shoppers are financially prepared and understand what to expect—reducing the likelihood of post-purchase regret.

“Buyers hold more of the cards. … They are able to ask for concessions. They’re able to negotiate, at least to a degree, with sellers,” says Eddy.