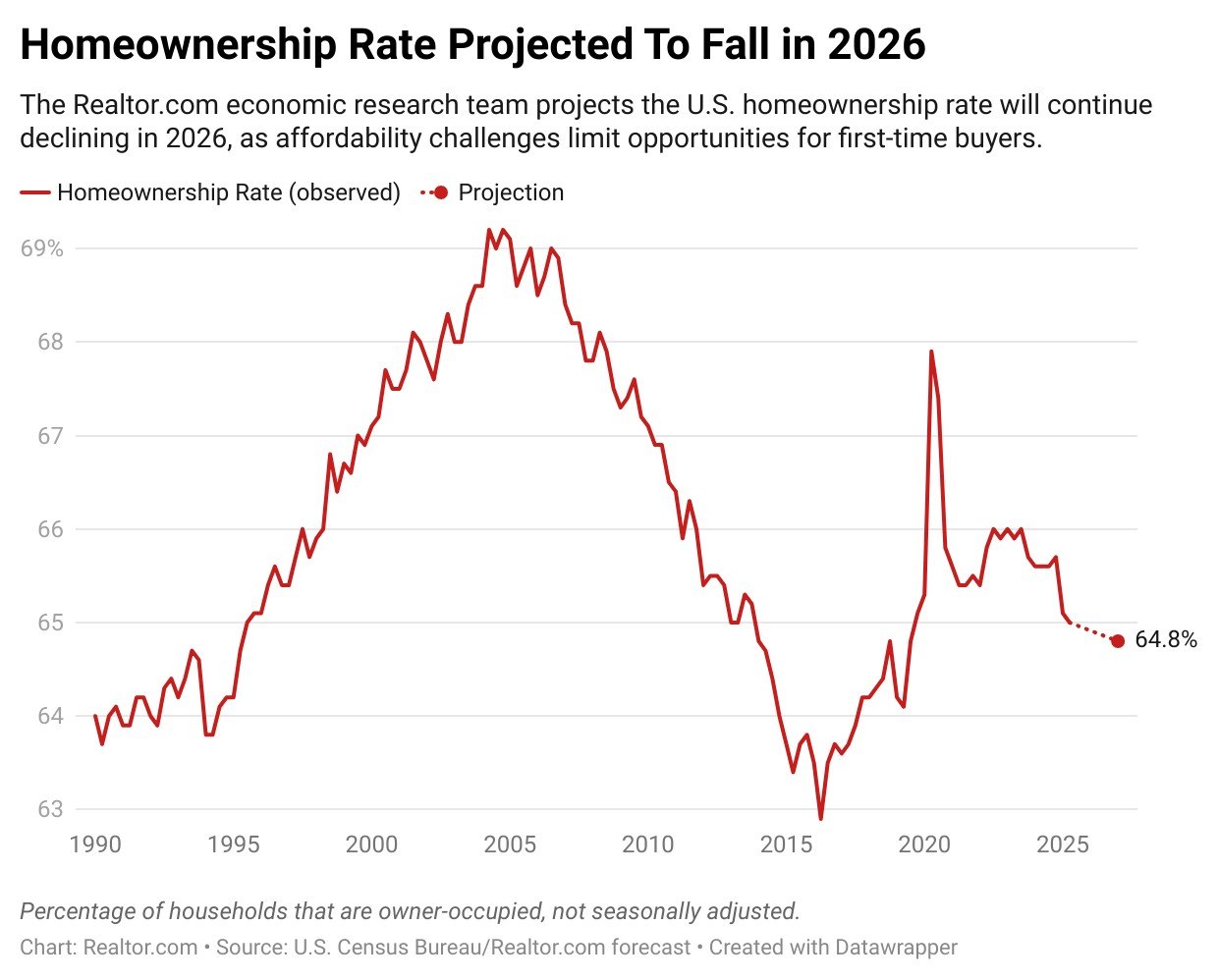

Homeownership Rate Expected To Fall Further in 2026 After Hitting a 6-Year Low

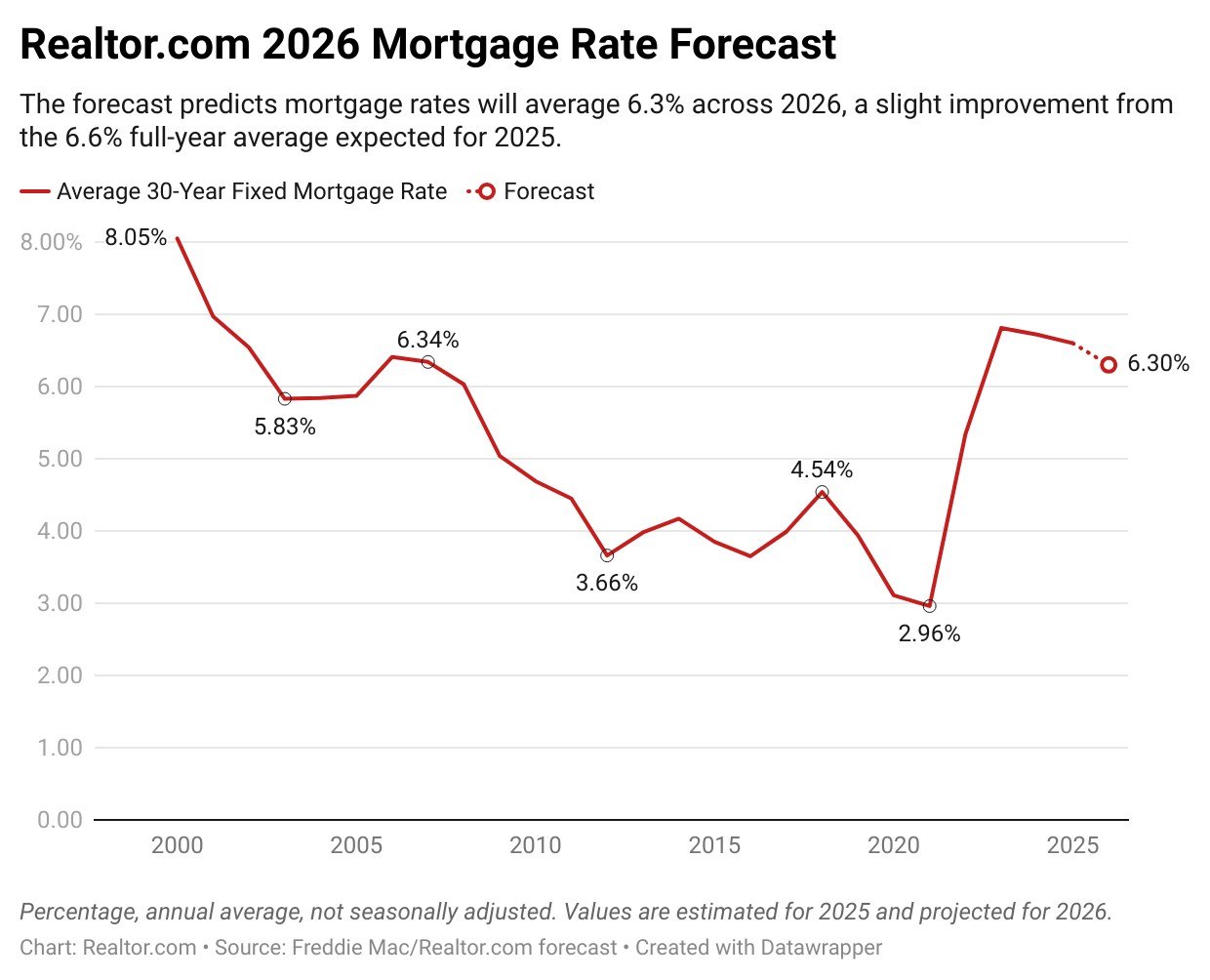

The homeownership rate in the United States is projected to fall further in 2026 after reaching a six-year low earlier this year, according to a new forecast from the Realtor.com® economic research team. The percentage of households that are owner-occupied has trended down over the last few years, hitting 65.0% in the second quarter of … Read more