Mortgage rates dipped yet again. The Freddie Mac 30-year fixed rate fell to 6.19%, its lowest level in more than a year. That’s a meaningful drop, and it comes as markets fully price in another possible Federal Reserve rate cut after it meets next week.

While this gives buyers some breathing room, it’s worth noting that further declines may be limited. That’s because there’s still uncertainty around a potential December policy move, and inflation expectations remain sticky.

After delays from the government shutdown, we finally got the report everyone’s been waiting for. The consumer price index, or CPI, showed inflation running at 3% year over year, a slight increase compared with 2.9% the previous month.

Meanwhile, core inflation, which strips out food and energy, also rose 3%. These numbers are critical for the Fed’s next steps, and they’ll heavily influence investor expectations for mortgage rates in the coming weeks.

Active inventory rose 15.1% year over year. That’s the 102nd consecutive week of annual gains, bringing the total to just over 1.1 million homes on the market.

New listings also ticked up 4.7% compared to last year, as more homeowners test conditions heading into year-end.

And buyers are responding. Homes are spending only four days longer on the market than a year ago, the smallest gap we’ve seen in months, and median list prices are up 0.4% year over year.

Our recent report on mortgage rate determinants showed shopping around for a lender remains the single biggest way to lower your rate, potentially by 0.55 percentage points, saving more than $40,000 over a 30-year loan.

Improving your credit score, especially moving from 660 to 720, and hitting that 20% down payment threshold can also make a big difference.

Even though getting to 20% can lower your mortgage rate, it’s not necessarily something that everyone can do. According to our latest Down Payment Report, the median down payment held steady at $30,400 in the third quarter. This is shy of that 20% mark.

Existing-home sales rose 1.5% from August to a 4.06 million annual rate, marking the third straight year-over-year gain. The median sales price reached $415,200.

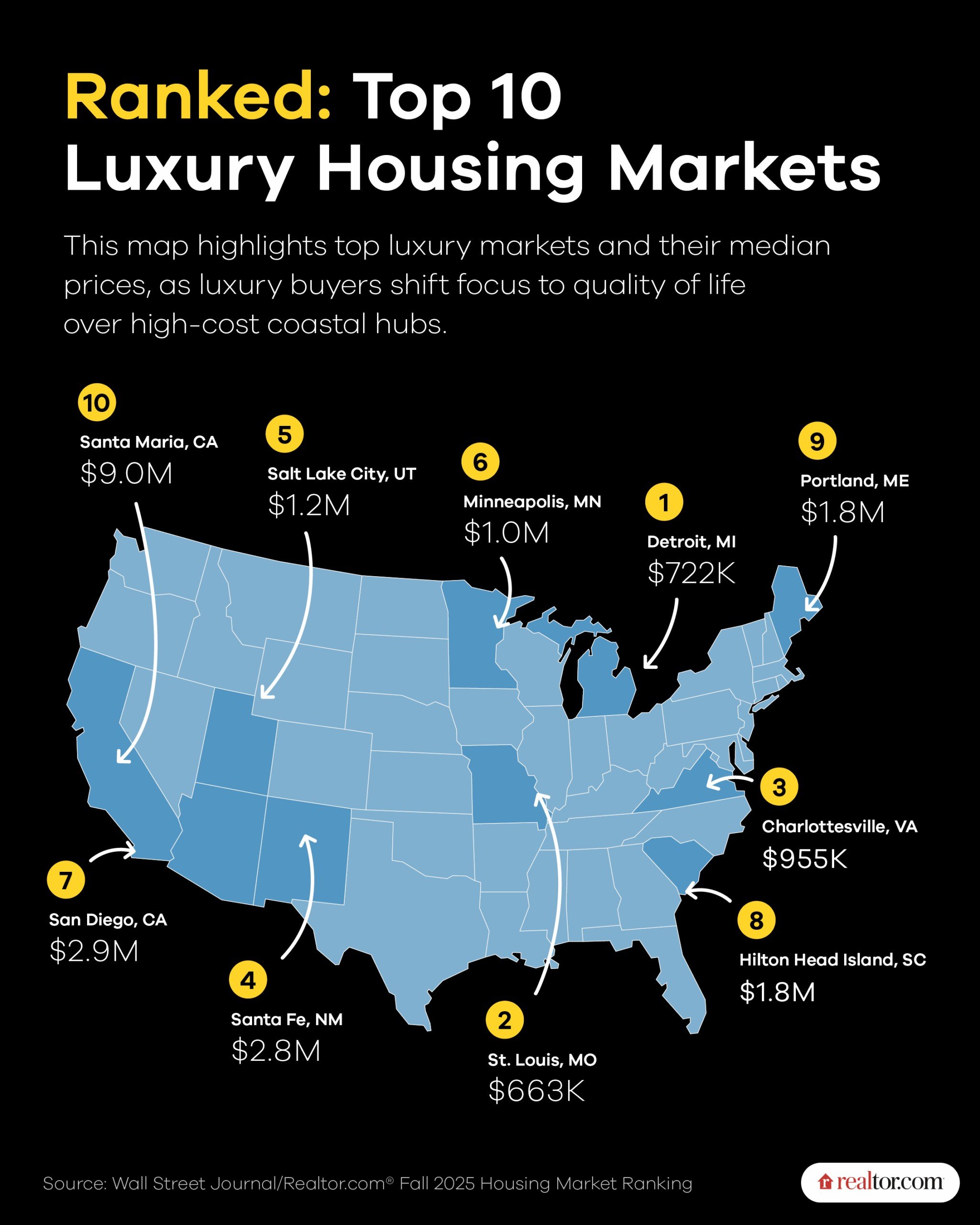

Regionally, the Northeast and Midwest remain especially tight because of limited new construction. Our collaborative report with the Wall Street Journal Fall 2025 Housing Market Ranking shows Manchester-Nashua, NH, holding its top spot, and several Midwest metros continue to attract attention with median prices between $240,000 and $400,000.

And even in the luxury segment, value is leading the way. Detroit tops our Luxury Housing Market Ranking, offering one of the most accessible paths into high-end housing, with the 90th percentile listing price just above $720,000.