Many homeowners have seen their places turn into cash machines, with property values across some parts of the nation surging.

Even though price growth has slowed because of high mortgage rates, affordability issues, and more homes hitting the market, a handful of metros stand out with big double-digit gains in recent years.

The basic principle is that home values are driven up or down by the supply of and the demand for homes in a given area.

“When there is a high volume of home sales, we expect values to increase, especially when there is not a corresponding increase to new construction activity that can match supply to demand,” says Realtor.com® senior economist Joel Berner.

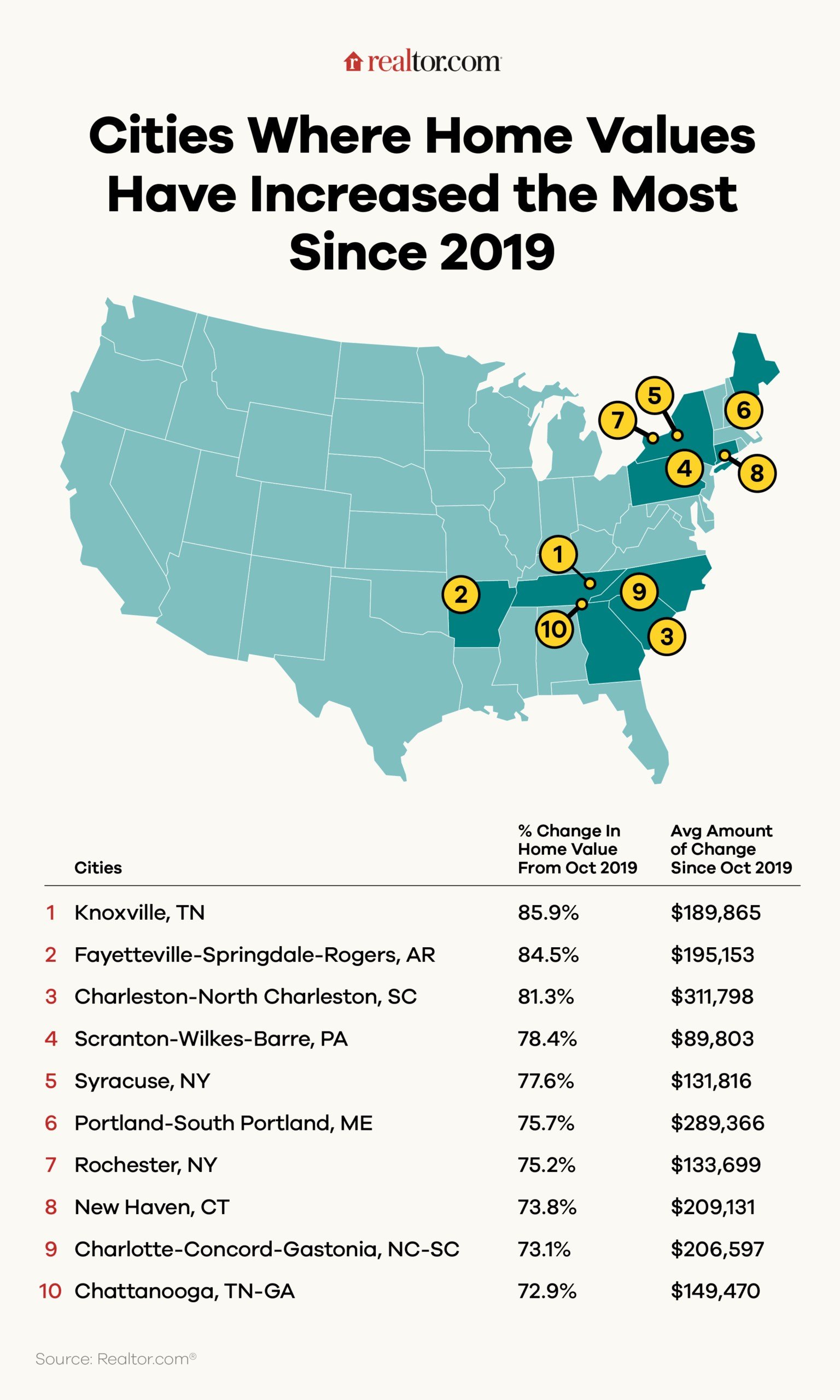

Since the pre-pandemic era, 10 cities—split evenly between the South and Northeast—stood out for experiencing the most significant home value increases across the top 100 U.S. metros but for different reasons, according to a new data analysis conducted by economists at Realtor.com.

Knoxville, TN, clinched the No. 1 spot, with the average home in Marble City seeing its value soar nearly 86%, or roughly $190,000, between October 2019 and October 2025.

Home to the University of Tennessee, Knoxville has become a top destination in the region, offering abundant job opportunities and a high quality of life blending urban and suburban living tailor-made for families, as well as plenty of outdoor activities.

Knoxville becomes a pandemic boomtown

“Around 2001 Knoxville, as a community, became laser-focused on becoming a great place to live, work, and play, and by 2019, it started getting noticed, nationally, for having done exactly that,” Regina Santore, a real estate agent at Wallace Real Estate in Knoxville, tells Realtor.com.

Santore says the city has much to offer, from a walkable, “human-scale” downtown with wide sidewalks to historic neighborhoods, breweries, art galleries, and over 50 miles of hiking and mountain biking trails just 2 miles away from the city center.

Perhaps most importantly, Knoxville continues to attract companies providing well-paying job opportunities and fostering a culture of innovation. On top of that, Tennessee has no state income tax, and Knoxville boasts a lower cost of living than many other parts of the U.S.

“With all that and four-season weather, there’s a lot to love about Knoxville, and the word has definitely gotten out,” says Santore.

Out-of-town homebuyers began flocking to Knoxville after 2018, sending the local market’s home value appreciation surging from 3% annually to 8% in just a couple of years.

“Sellers were amazed when they had a $40,000 windfall that they didn’t expect. It was fun to be able to deliver that news,” recalls the agent.

The arrival of the pandemic whipped Knoxville’s already red-hot housing market into a frenzy, with more than a dozen offers on every for-sale home. At the peak of the global health crisis, Knoxville’s annual home value appreciation rate soared to 28%.

“The amount of equity sellers realized [they had] was incredible, with some making $100,000 after owning for just a year,” says Santore.

But the surge in home values wound up being a double-edged sword, leaving buyers and renters alike financially squeezed and leading to a spike in homelessness.

As mortgage interest rates began trending up in the post-pandemic era, Santore says Knoxville’s home appreciation rate eased to 3% per year. Even so, many millennial and Gen Z buyers looking to purchase a starter home remain priced out of the market because of affordability constraints fueled in part by insufficient new construction.

“Knoxville sellers are having to come to terms with having to give in to some concessions in order to sell their home, and that they will not be seeing the kind of appreciation we saw during the pandemic while they have their home on the market,” notes the agent.

Arkansas’ new-construction destination

Fayetteville, AR, came a close second: there, a typical home appreciated a stunning 84.5% over the past six years, with its value rising more than $195,000.

Fayetteville’s gains should come as no surprise given its proximity to the corporate headquarters of both Walmart and Tyson, as well as being the seat of the University of Arkansas.

In August, the bustling Arkansas hub topped the list of best metros for new-home construction in 2025, according to a ranking released by Realtor.com.

Fayetteville distinguished itself for both the affordability and availability of its new builds, which at the time made up 40% of the city’s for-sale listings.

Another Southern entry, Charleston, SC, took bronze, with home values rising on average 81.3%, or $311,798.

Founded in 1670, Charleston is renowned for its rich history, beautifully preserved antebellum architecture, and horse-drawn carriages clip-clopping along cobblestoned streets lined with elegant, pastel-colored homes.

Visitors are drawn to famous local sites like Fort Sumter and the Battery, Charleston’s thriving arts and music scene, top-notch restaurants, and pristine beaches.

“The metros at the top of the list are a bit of a mix when it comes to new-construction activity,” says Berner. “Some of them are seeing values grow even as new-construction activity has been high. This is a great sign for the overall growth of the metro area, that people are willing to move there and buy homes at a pace that keeps values moving up.”

Scranton, PA—arguably best known as the home of the fictional Dunder Mifflin paper company from NBC’s beloved sitcom “The Office”—recorded the strongest home-value growth in the Northeastern region since 2019, rising 78.4% ($89,803). Syracuse, NY, followed closely at 77.6% ($131,816), rounding out the top five.

Notably, the Central New York metro recorded the highest year-over-year home value increase of 8.8% in October.

Other metros that experienced healthy home value growth topping 70% since 2019 include Portland, ME (75.7%); Rochester, NY (75.2%); New Haven, CT (73.8%); Charlotte, NC (73.1%), and Chattanooga, TN (72.9%).

Berner says metros ranked toward the bottom of the list have seen their home values increased mostly because of supply shortages and subdued new-construction rates.

“There aren’t many homes for sale or new homes being built, but demand for homes remains strong and those prices get bid up,” says Berner.

On the other side of the spectrum, New Orleans saw the lowest home value increase since 2019 among the top 100 metros, at just 22.8%, followed by San Francisco at 23.6%, and Baton Rouge, LA, at 27.7%.

Berner says weak population growth is the main culprit for the sluggish home value growth in those metros.

“These are parts of the country that people are generally leaving due to affordability issues, or a lack of economic prospects,” he says.