Buying a home is the biggest purchase most Americans will ever make. And for many, closing day wipes out years of savings in a single transaction. That’s why move-in-ready homes feel so safe: No major renovations, no big surprises—just unpack and start living.

But in reality, an untold number of unlucky buyers face the opposite. And only after the boxes are unpacked do hidden defects emerge, turning a dream home into a lemon.

It’s a nightmare that’s growing more common as America’s aging housing stock shows its age. Nearly half of all owner-occupied homes were built before 1980, and the median home age is now 41 years, according to the National Association of Home Builders. Old roofs, brittle plumbing, outdated wiring, and stressed foundations all increase the odds that buyers inherit problems they never saw coming.

“In states with older housing, lemons show up more often,” says Andrew Fortune, owner of Great Colorado Homes. His warning reverberates across markets where harsh weather and deferred maintenance collide.

Some states have begun responding. In Massachusetts, where aging homes and pyrrhotite-contaminated concrete have blindsided buyers, sellers are prohibited from waiving a home inspection as a provision of accepting an offer, in a move meant to empower more buyers to fully understand what they’re buying into.

But most states offer far fewer protections, leaving buyers to fend for themselves.

So where are lemon homes most common, and what should buyers watch for before signing on the dotted line? Here’s what the data shows.

The lemon home hot spots

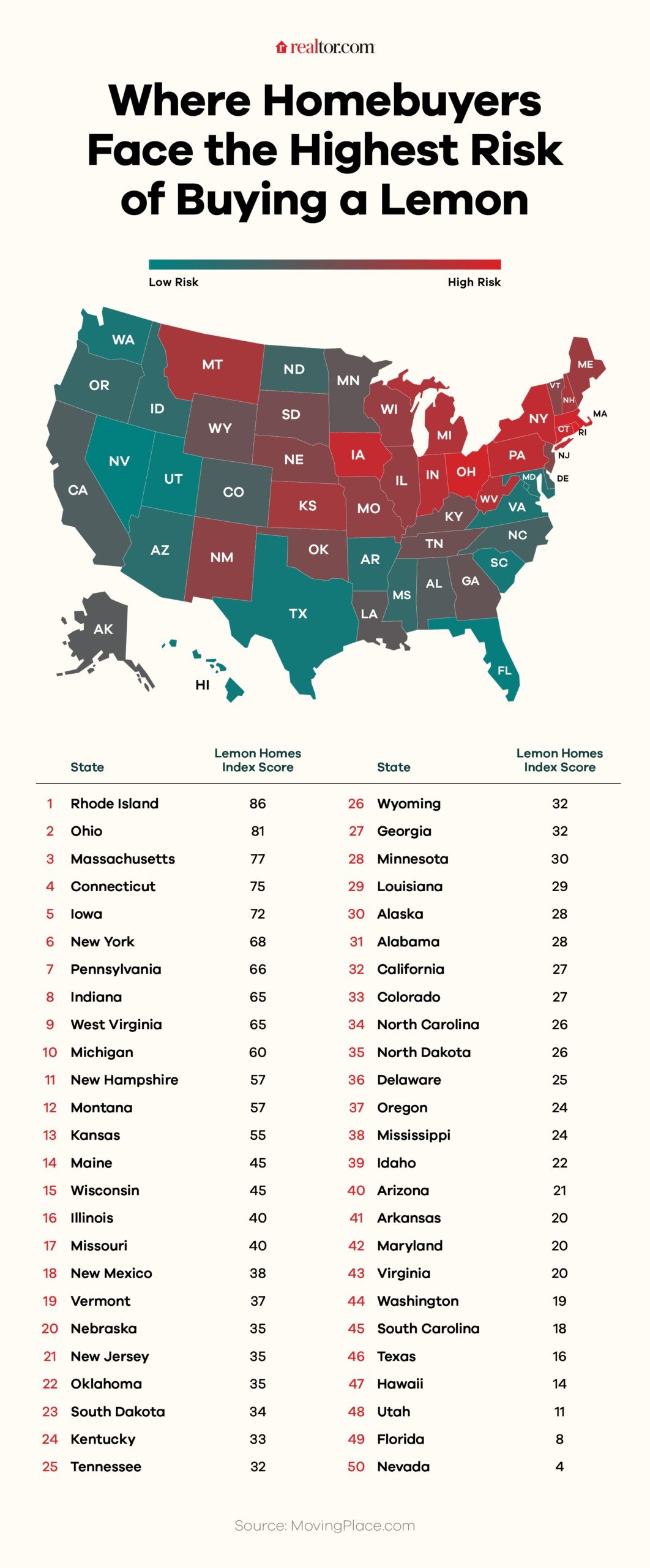

Lemon homes are everywhere, but a new report from MovingPlace shows that the burden isn’t shared equally among the states. Rust Belt states with aging housing stock and a harsh weather cycle lead the Lemon Home Index, a measure of how common housing problems are in one area compared to others.

Rhode Island and Ohio top the Lemon Home Index, with respective scores of 86 and 81 out of 100. They’re followed by Massachusetts (77), Connecticut (75), and Iowa (72). In these states, historical and midcentury homes are common—as is the punishing weather that wreaks havoc on roofs, plumbing, windows, and foundations.

At the metro level, the riskiest places are Erie, PA; Cleveland; Binghamton, NY; Buffalo, NY; and South Bend, IN—each coming in with a score above 80. They all share the same underlying vulnerability: large numbers of older homes built long before modern construction standards, paired with climates that accelerate deterioration.

What makes these metros especially dangerous for buyers, though, is that they are also some of the most affordable in the country. Median list prices in these cities fall well below the national median of $420,000—with Cleveland coming in at the lower end of the spectrum at about $135,000 and Buffalo topping it out near $230,000.

That affordability draws eager buyers in. But it also risks exposing cash-strapped house hunters to the much more expensive reality of needing to upgrade failing home systems just to keep a house livable.

Why move-in-ready homes may hide the most problems

For many buyers, fresh paint and stylish staging signal that a home has been cared for. But experts say those polished finishes can also mask the most expensive defects, especially in markets where older housing stock and quick-turn flips collide.

Harrison Stevens, vice president of marketing at TurboTenant, says the issue often begins with investor priorities. He notes that “investors [look] for the cheapest properties possible to flip, hiding those damages with cosmetic fixes,” and warns buyers to be “especially cautious when these homes are in low-cost or run-down areas,” where speed and aesthetics tend to win out over structural integrity.

In Colorado Springs, CO, Fortune sees the same pattern. Beneath updated interiors, he frequently finds signs of foundation movement caused by the region’s clay-heavy soils.

“Our Front Range soils are clay-heavy and expand and contract in response to changes in moisture. This puts stress on foundations and slabs, causing them to crack and heave,” he says. Those issues often disappear behind fresh flooring and paint, making them nearly impossible for buyers to spot.

Fortune adds that aging systems are just as easy to hide: “Older homes often conceal plumbing issues and quick-fix wiring repairs behind fresh drywall and paint, which local inspectors say is common when investors rush to renovate.”

What looks move-in-ready can actually be decades of deferred maintenance disguised by cosmetic upgrades.

Climate accelerates these risks. Freeze–thaw cycles across the Northeast, Midwest, and even the Mountain West warp foundations, roofs, windows, and plumbing well before buyers ever walk through the door.

As Fortune puts it, “roofs take a beating from hail, sun, and rapid temperature swings,” leaving behind bruising and structural damage that doesn’t show up in listing photos.

Even longtime renovation professionals are raising red flags.

Ryan Dossey, co-founder of SoldFast, says that in lemon-prone states, “humid weather and old housing stock are two key factors that lead to the potential for structural issues lemon homes are known for.”

Over time, he says, older homes have “had a long time to accumulate hidden issues in the foundation or utility systems,” especially in areas where some investors “cut corners” during aggressive Opportunity Zone rehabs.

Why this matters now more than ever

With affordability stretched thin, many buyers are funneled straight into the older housing stock, where hidden defects are most common. And the financial impacts can be devastating for new homeowners.

The Harvard Joint Center for Housing Studies estimates that the average household now spends $7,100 per year on home repairs. But lemon homes can blow far past that baseline once aging plumbing, faulty wiring, or foundation movement starts revealing itself.

Insurance pressures add another layer of risk. Carriers across the country are tightening underwriting standards, pulling back from high-risk areas, and scrutinizing roof age, electrical systems, and water-related claims more closely than ever.

Claims to update damaged systems can trigger insurance inspections, coverage denials, or expensive required repairs—all at a moment when building materials and labor costs remain elevated.

How buyers can avoid the lemon home trap

There’s one simple and effective way to avoid buying a lemon that’s actually baked into the homebuying process, but after years of a hyper-competitive seller’s market, it’s fallen by the wayside. And today, as many as 1 in 5 homebuyers waives the one thing that could prevent them from buying a lemon home, according to data from the National Association of Realtors®.

A home inspection is a top-to-bottom examination of a property’s major systems and structure, performed by a licensed inspector before you close on the home. Think of it as a health check for the house. The inspector looks for problems that most buyers can’t spot on their own: roof damage, foundation cracks, electrical hazards, plumbing leaks, mold, moisture intrusion, drainage issues, faulty HVAC systems, and signs of past or ongoing water damage.

Stevens put it bluntly: “Always make sure to get a home inspection before buying—don’t be enticed to put in a quick offer due to a low asking price.”

That advice holds true across markets.

“Requesting a thorough structural and drainage review, a radon test, and often a sewer scope can catch the defects that generalists miss,” Fortune says.

Permit and repair histories help tell another story: whether expensive upgrading work was done properly throughout the years or avoided altogether. Realtor.com® makes it easy to access this data right in a property’s listing, so you can get an idea before even going to an open house.

Fortune notes that many of the most serious homeowner complaints come from issues a walk-through wouldn’t catch.

“A buyer closes, then weeks later finds water in a basement, sewage backing up, or severe wall cracks,” he explains. “They later learn there was a history of those problems that never made it onto the disclosure.”

It’s a prescient warning. To avoid buying a lemon, don’t just look for a house in the right neighborhood or with the best square footage. Look for a house that has documented maintenance throughout the years and that gets the green light from a licensed home inspector.