Mortgage rates ticked up slightly on Thursday but essentially held steady as markets took a pause amid cautious optimism over the federal government’s reopening after the longest-ever shutdown, tempered by lingering economic uncertainty.

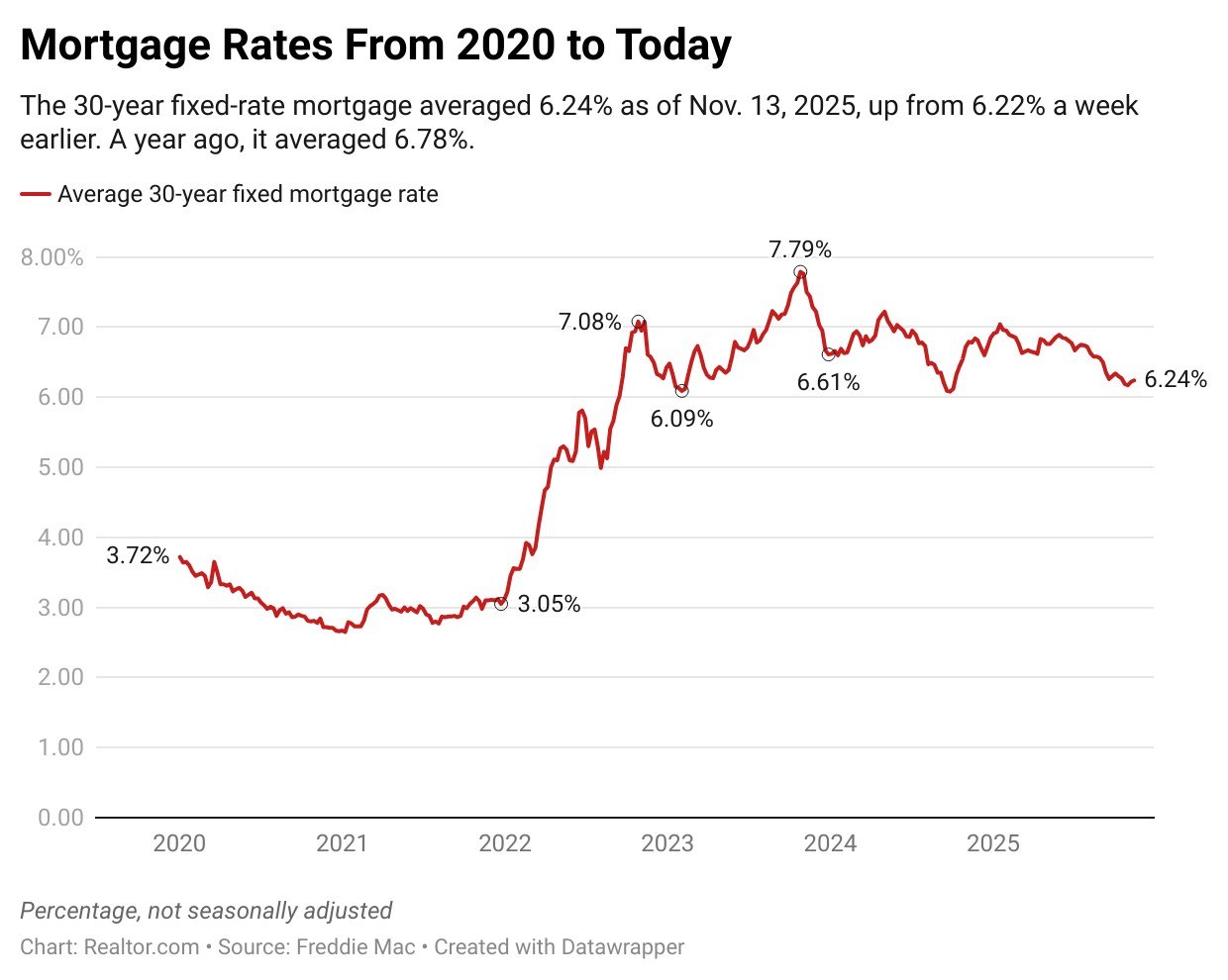

The average rate on 30-year fixed home loans rose to 6.24% for the week ending Nov. 13, up from 6.22% the week before, according to Freddie Mac. Rates averaged 6.78% during the same period in 2024.

“Rates for the 30-year and the 15-year fixed-rate mortgage essentially remained flat this week, but we did see purchase activity increase, which is encouraging,” says Sam Khater, Freddie Mac’s chief economist.

Realtor.com® Senior Economist Anthony Smith notes that the rate remained relatively flat as the 10-year Treasury yield stabilized, with no major catalyst to drive it significantly higher or lower. It follows the Federal Reserve’s latest quarter-of-a-point cut to its overnight rate in October and ahead of its next Federal Open Market Committee (FOMC) meeting on Dec. 9-10.

Federal Reserve Chairman Jerome Powell previously said that another rate reduction this year was far from certain, and the central bank’s stance that “policy is not on a pre-set course” is already largely priced into the market.

Meanwhile, Smith says that the absence of a recent jobs report and other key economic data because of the shutdown, which ended on Wednesday night following a House vote, leaves the market without definitive information on the health of the economy, reinforcing the current holding pattern for interest rates.

“The housing market’s main challenge is now the lagged rebound following the government shutdown, creating continued friction in the immediate post-reopening period,” explains the economist.

Smith predicts that the return to normal operations will be slow, as agencies critical to the mortgage process, such as the Federal Housing Administration (FHA) and the U.S. Department of Agriculture (USDA) Rural Housing, will be plowing through weeks of accumulated file backlogs, delaying transactions for days or weeks.

“For every day the government was shut down, there will likely be a comparable delay for an agency to clear its queue fully,” he adds.

For households, especially those affected by the 42-day disruption, it will take some time to rebuild their financial confidence before they are ready to re-enter the housing market, according to Smith.

Despite stable borrowing costs, home sales remain subdued as the inventory slowly improves. Motivated buyers who have been waiting for a decisive mortgage rate drop may be disappointed by the current holding pattern.

Smith describes the funding package signed by President Donald Trump on Wednesday, ending the stalemate between Republicans and Democrats, as a “time-out, not a solution,” as the Continuing Resolution expires on Jan. 30, ensuring that fiscal uncertainty will resurface in the new year.

The good news for veterans is that VA loans received full-year funding certainty, providing greater stability for one of the most beneficial mortgage products on the market, which can unlock homeownership years sooner due to its 0% down payment feature.

“This stability contrasts with the broader market, which continues to struggle with affordability, prompting discussions of non-traditional solutions, such as the 50-year mortgage, a proposal that risks driving up home prices by boosting demand without increasing supply,” concludes Smith.

How mortgage rates are calculated

Mortgage rates are determined by a delicate calculus that factors in the state of the economy and an individual’s financial health. They are most closely linked to the 10-year Treasury bond yield, which reflects broader market trends, like economic growth and inflation expectations. Lenders reference this benchmark before adding their own margin to cover operational costs, risks, and profit.

When the economy flashes warning signs of rising inflation, Treasury yields typically increase, prompting mortgage rates to go up. Conversely, signs of falling inflation or weakness in the labor market usually send Treasury yields lower, causing mortgage rates to fall.

The mortgage rates you’re offered by a lender, however, go beyond these benchmarks and take some of your personal factors into account.

Your lender will closely scrutinize your financial health—including your credit score, loan amount, property type, size of down payment, and loan term—to determine your risk. Those with stronger financial profiles are deemed as lower risk and typically receive lower rates, while borrowers perceived as higher risk get higher rates.

How your credit score affects your mortgage

Your credit score plays a role when you apply for a mortgage. A credit score will determine whether you qualify for a mortgage and the interest rate you’ll receive. The higher the credit score, the lower the interest rate you’ll qualify for.

The credit score you need will vary depending on the type of loan. A score of 620 is a “fair” rating. However, people applying for a Federal Housing Administration loan might be able to get approved with a credit score of 500, which is considered a low score.

Homebuyers with credit scores of 740 or higher are typically considered to be in very good standing and can usually qualify for better rates.

Different types of mortgage loan programs have their own minimum credit score requirements. Some lenders have stricter criteria when evaluating whether to approve a loan. They want to make sure you’re able to pay back the loan.