Macquarie Capital | Principal Finance and Vanderbilt Office Properties sold a multifamily development site approved for nearly 300 units in Boca Raton for $21.2 million.

NADG, or North American Development Group, bought the 6.8-acre site at 1800 North Military Trail, according to records and real estate database Vizzda. The land shares the same lot as a four-story building and a garage that are part of the Boca Center office campus. Macquarie and Vanderbilt kept the office building and garage.

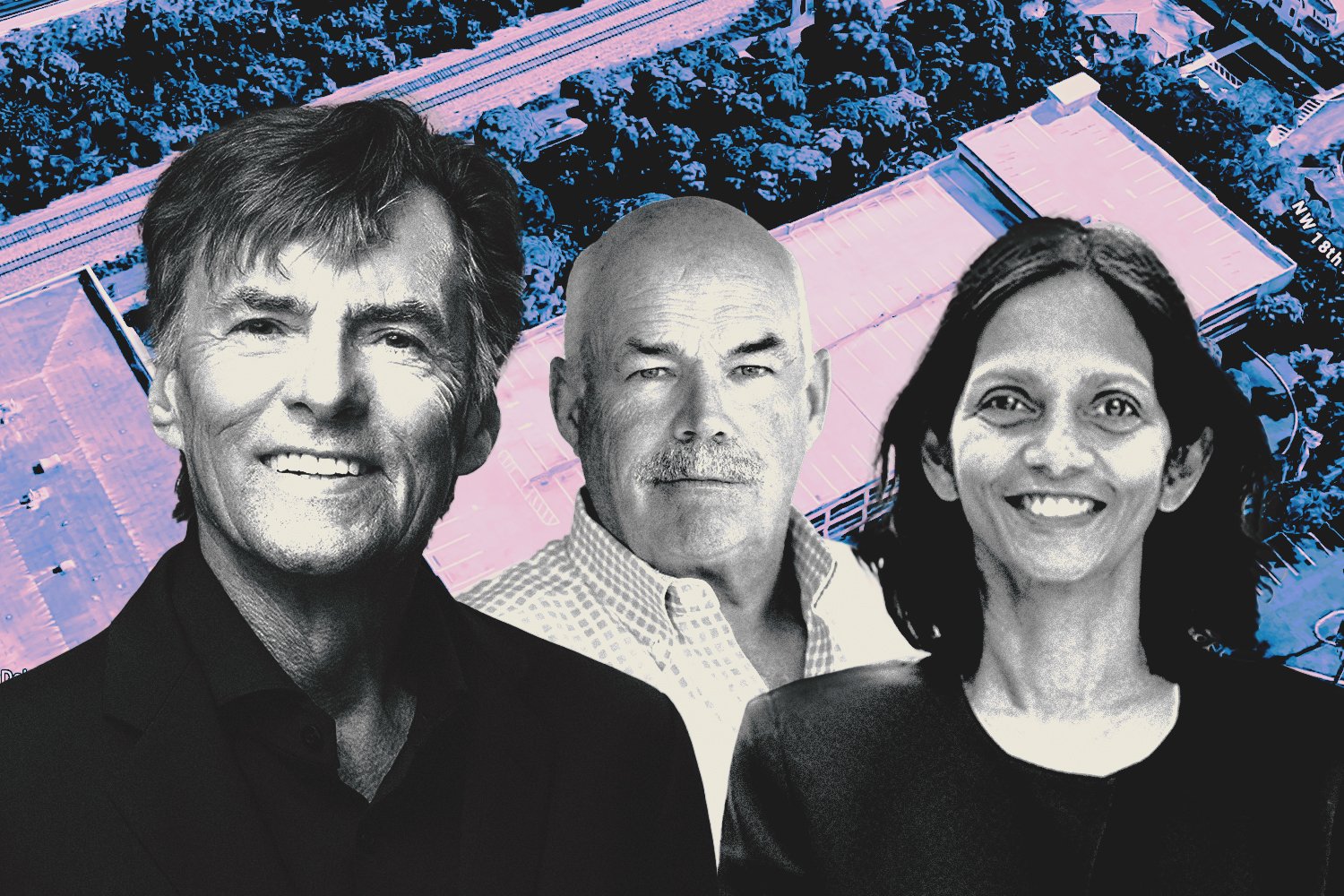

NADG, which has offices in West Palm Beach and Toronto, Ontario, is a retail, residential and mixed-use investment firm that John W. S. Preston founded in 1977, its website shows. Jeff W. Preston is CEO. The firm has a portfolio consisting of more than $6 billion of assets under management, including roughly 10,000 units and over 19 million square feet of retail and mixed-use space.

The Boca Raton site is proposed for a six-story building with 295 apartments, including 30 units at affordable rents and 15 units at workforce rents, Vizzda data shows. It would have six studios, 134 one-bedroom apartments, 113 two-bedroom apartments and 42 three-bedroom apartments. The height is proposed for 66 feet, which generally would mean a roughly six-story building.

About half the site would be open space.

Macquarie and Vanderbilt bought the majority of Boca Center, including the lot at 1800 North Military Trail, for $261.5 million in 2022. The pair had paid $76.1 million for the 1800 North Military Trail site.

Macquarie is the financing and investment division of Sydney, Australia-based Macquarie Group, led by CEO Shemara Wikramanayake.

Chicago-based Vanderbilt is an office investor led by CEO Casey Wold. It has a portfolio of 13 million square feet, its website shows.

South Florida is experiencing continuing multifamily development, despite a supply overhang due to hefty completions in recent years. Last year, developers finished 18,600 apartments in the tri-county region, outpacing 15,000 net new leases, according to CoStar Group.

The construction spree has raised concerns about a prolonged supply overhang, which could continue downward pressure on rent growth and continuing concessions, experts have said. But developers argue that by the time they finish their buildings, the current supply will be absorbed and demand will be higher.

Also in Boca Raton, Group P6 and Mill Creek Residential plan the 12-story, 306-unit Modera Boca at 400 South Dixie Highway. Arnaud Karsenti’s 13th Floor Investments scored approval in January for the eight-story, 340-unit Boca Village apartment project at 680 West Yamato Road in Boca Raton.

Many developers have seized on the Live Local Act, a state law that rewards developers with property tax breaks if they include below-market rate apartments. The legislation also allows developers to build bigger buildings than permitted by zoning.

In Coral Gables, Shoma Group plans the 16-story, 201-unit Ponce 8 at 3808-3850 Southwest Eighth Street, marking the first known Live Local Act project in the city.

Read more

Development

South Florida

“The world turned”: Why developers are selling South Florida multifamily sites

Development

South Florida

Boca Raton approves 289-unit mixed-income apartment project