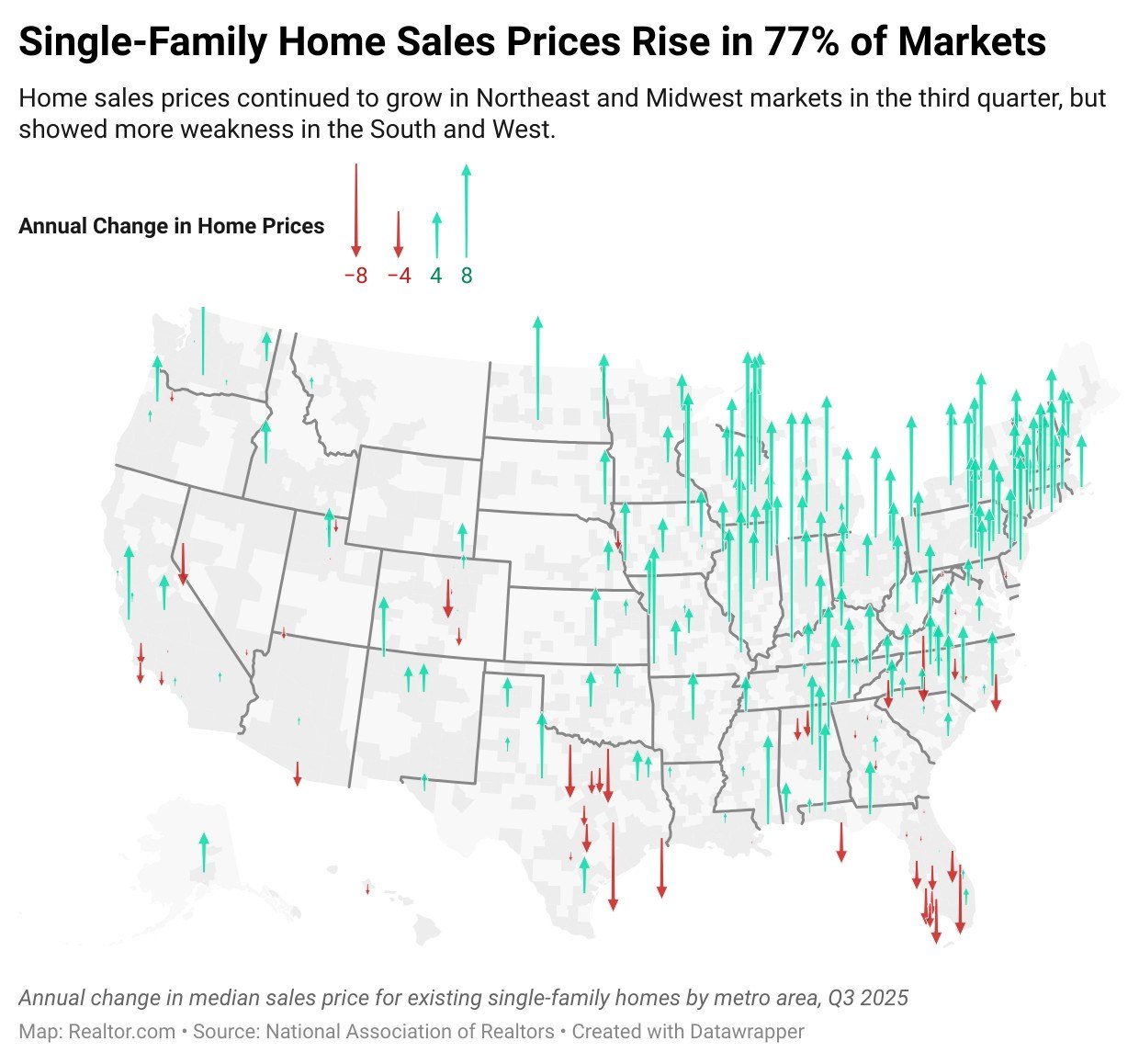

Home prices fell annually in 23% of markets last quarter, but price growth remained strong in the Northeast and Midwest, according to new data from the National Association of Realtors®.

Median sales prices for existing single-family homes declined on an annual basis in 51 metro areas out of the 230 tracked, while rising in 176 markets (77%), according to the NAR’s quarterly report released on Thursday.

The markets with falling prices were clustered in the South and West, with parts of Texas and Florida seeing some of the biggest declines. Meanwhile, the Northeast and Midwest continued to see healthy gains.

Nationally, home sales prices rose 2.2% from a year ago in the third quarter, which included sales that closed in July, August, and September.

“Home sales have struggled to gain traction, but prices continue to rise, contributing to record-high housing wealth,” says NAR Chief Economist Lawrence Yun. “Markets in the supply-constrained Northeast and the more affordable Midwest have generally seen stronger price appreciation.”

Among large markets, Trenton, NJ saw the biggest annual price gain of 9.9%, followed by Lansing, MI (9.8%) and New York’s Long Island (9.4%).

Larger markets with falling prices included Reno, NV (-3.6%), Boulder, CO (-3.3%), and Tampa, FL (-2.4%).

Among the markets tracked by NAR, only one with falling prices was located outside the South or West: Sioux City, IA, where home prices were down -1.6% annually.

“Ample supply in the South and West has eased pressure on home prices, while tight inventory in the Northeast and Midwest continues to push prices higher,” says Realtor.com® senior economic data analyst Hannah Jones. “Even with recent cooling, prices in the South and West remain near record highs, so buyers there aren’t necessarily finding bargains, just more choices.”

Yun noted that price declines are occurring mainly in southern states, where there has been robust new home construction in recent years, helping to alleviate supply constraints.

“Given the region’s faster job growth, these price drops should be viewed as temporary and as a second-chance opportunity for those previously priced out of the market,” he says.

Typical monthly payments for homebuyers

Nationally, the typical monthly mortgage payment for a home purchased in the third quarter would be $2,187, assuming a down payment of 20%, according to the NAR report.

That median monthly payment is down 2.8% from the prior quarter, but up 2.1% from a year earlier.

The average family who bought a home last quarter is spending 24.8% of their income on monthly mortgage payments, down slightly from 25.2% a year ago due to rising incomes.

For first-time buyers, the typical mortgage payment on a starter home was $2,146, taking NAR’s assumption of a home valued at $362,800 with a 10% down payment.

First-time buyers are spending 37.4% of their income on mortgage payments on average, down from 38.1% a year ago.

A recent NAR report found that the typical first-time homebuyer is now 40 years old, a record high. First-time buyers accounted for just 21% of all home purchases this year, the lowest share on record.