Blinded by a data blackout during the government shutdown and deeply divided on the correct path forward, top Federal Reserve officials are meeting again to decide their next move on interest rates.

Fed Chair Jerome Powell is joining other members of the Federal Open Market Committee (FOMC) in Washington, DC, on Tuesday for the two-day meeting, which will culminate in a vote on interest rates Wednesday afternoon.

With near certainty, financial markets expect the FOMC to cut the Fed’s overnight interest rate by a quarter point, taking it to a range of 3.75% to 4%. Last month, the Fed made its first rate cut in nine months, following troubling signs of weakness in the labor market.

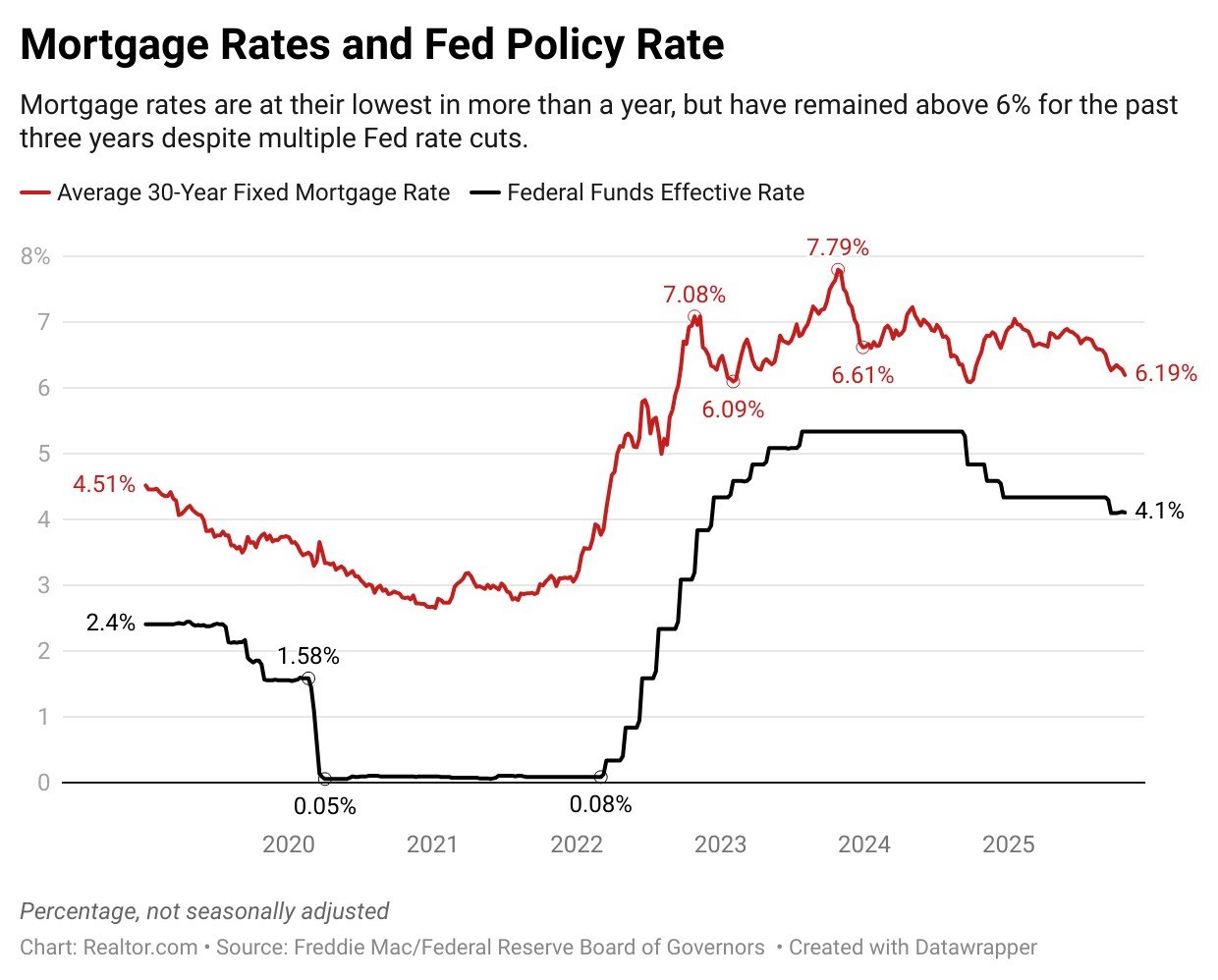

In anticipation of further rate cuts at the Fed, mortgage rates last week dipped to their lowest level in more than a year, hitting 6.19%, according to Freddie Mac. But a rate cut Wednesday doesn’t mean they will fall further, with much riding on Powell’s comments in a post-meeting press conference.

“The Fed’s decisions are anticipated by the market, which means that the upcoming rate cut and several more over the next few months are already largely priced in” to mortgage rates, says Realtor.com® Chief Economist Danielle Hale, who notes that “further declines will depend on new developments.”

The Fed uses higher interest rates to combat inflation, and lower interest rates to stimulate the labor market, in line with its dual mandate of price stability and maximum employment.

The Fed does not set mortgage rates directly, and instead sets the short-term rate for overnight lending between commercial banks. Still, expectations about future Fed policy and general financial conditions can influence long-term rates, including mortgage rates.

Growing divisions among FOMC members

There are 12 voting members of the FOMC, including the seven members of the Federal Reserve Board of Governors, four rotating regional Fed presidents, and the president of the New York Fed. A majority vote is needed to set policy on interest rates.

Last month, the vote was split 11-1 in favor of a quarter-point rate cut, with newly appointed Fed Gov. Stephen Miran as the lone dissenter, instead voting for a larger half-point rate cut.

In public comments, Miran has indicated he believes the Fed should make larger half-point rate cuts both this week and in December, and signaled his intent to vote for such cuts even in the face of opposition from the majority of the panel.

“I’m not going to vote for something I don’t believe in, just for the sake of creating an illusion of consensus where there is none,” Miran said in comments at the Economic Club of New York last month.

Miran says that he believes the Fed’s “neutral rate,” which is the rate that neither spurs additional spending nor restricts the economy, is close to 2%, and argues that the central bank should move quickly toward that level.

In contrast to Miran’s dovish position on rate policy, it is clear that there are hawks on the FOMC who are wary of making further cuts, and may vote this week to leave the federal funds rate unchanged.

Minutes from the last Fed meeting indicated that “a few participants” argued against cutting rates during the closed deliberations in September.

Those members noted that progress toward 2% annual inflation appeared to have stalled, with inflation back on the rise in recent months, according to the summary of the meeting.

Kansas City Federal Reserve Bank President Jeff Schmid and St. Louis Fed President Alberto Musalem are among the FOMC members seen as potentially hawkish dissenters in favor of holding rates steady at Wednesday’s vote, based on their recent public comments.

“One worrying sign is that price increases are also becoming more widespread,” Schmid told the CFA Society Kansas City this month, noting that a growing share of the categories tracked in official inflation statistics had increasing prices.

“I view that as a sign that policy is appropriately calibrated rather than a sign that the policy rate should be aggressively lowered,” he said.

Musalem has said he views the current federal funds rate as close to neutral, and believes the central bank should be careful not to cut rates too quickly.

“I am open minded to future potential reductions in interest rates. I do believe we need to move cautiously because the room between now and the point where policy becomes overly accommodative is limited.”

Inflation data released Friday showed that the Consumer Price Index increased 3% in September from a year earlier, marking the sixth straight month of rising annual inflation.

At the same time, the latest available labor market data showed an uptick in the unemployment rate, which rose to 4.3% in August, creating a tricky balancing act for Fed policymakers.

“We are currently in a challenging position, because the risks to both sides of the FOMC’s mandate—employment and inflation—are elevated,” Fed Gov. Michael Barr said in recent comments in Minneapolis. “The most difficult circumstances for making monetary policy decisions are when both mandate variables are at risk.”

Government shutdown creates data blackout

In some respects, the FOMC is flying blind in this meeting after the government shutdown halted the release of most federal data on the economy.

The CPI data released last week was an exception, deemed critical because it is used to calculate cost-of-living adjustments for Social Security recipients. But other reports on job growth, jobless claims, and consumer spending have gone silent.

“The delay in the September employment report in particular makes it harder to know whether the labor market is continuing to soften or is stabilizing,” Fed Gov. Christopher Waller said in recent comments at the Council on Foreign Relations in New York.

Waller in his remarks noted that the lack of data is particularly challenging at a time when the overall economy appears to be expanding, while the labor market is softening, creating a puzzling contradiction.

“What I would want to avoid is rekindling inflationary pressure by moving too quickly and squandering the significant progress we have made taming inflation,” said Waller.

On the other hand, Waller said that he favors multiple further cuts if the labor market continues to soften or weaken, and inflation remains in check.

“The labor market has been sending some clear warnings lately, and we should be ready to act if those warnings are validated by what we learn in the coming weeks and months,” he said.